Fathoming the Depth

Despite their heavyweight presence in international trade, the BRICS countries are barely integrated into global financial and human flows and interact with one another on an exceedingly limited scale. Yet Pankaj Ghemawat, who co-authored the Depth Index of Globalization, believes that this state of affairs still offers great opportunities. If the BRICS decide to seriously tackle globalization issues, they stand to tap into new and powerful growth points.

BRICS Business Magazine describes its “supreme purpose” as “to offer a direct information nexus between key BRICS cities” rather than the typical indirect path that “reaches the developing world through the developed markets.” The Depth Index of Globalization (DIG) 2013 (free download at www.ghemawat.com/dig), which I co-developed with Steven A. Altman, sheds light both on the limited direct interactions between the BRICS countries as well as the limited depth of their international activity on a global basis. DIG was assembled based entirely on hard data, and extends beyond only information flows to also capture the trade, capital, and people flows (the report’s four ‘pillars’ of globalization) among 139 countries that together account for 99% of the world’s GDP and 95% of its population.

Before delving into the BRICS countries specifically, let us start with some perspective on the state of globalization worldwide. World trade as a percentage of GDP dipped slightly in 2012 – although rounded off, it remained at 32%, slightly below its all-time (pre-crisis) peak. And foreign direct investment (FDI) dropped by 18%. But the recovery in international portfolio equity, the gradual increase in international people flows, and the more rapid increase in cross-border information flows paint a more positive picture than a narrow focus on trade and FDI would imply.

Looking beyond only trends over the past year, globalization was hit hard at the onset of the crisis in 2008 and, despite a partial recovery since then, the world remains less deeply globalized than it was before the crisis began. The world, in absolute terms, is also far less globalized than commonly presumed. Surveys of business executives I have conducted indicate that even experienced international business leaders tend to overestimate the depth of trade, capital, information, and people flows by three times or more. The share of the world’s population who are first generation immigrants, for example, is only three percent – the same as it was in 1910! Western Europeans guess immigrants make up 25% of their countries’ populations, about twice the correct answer of 12%. Americans are even further off, guessing 42% (versus the correct answer of 14%).

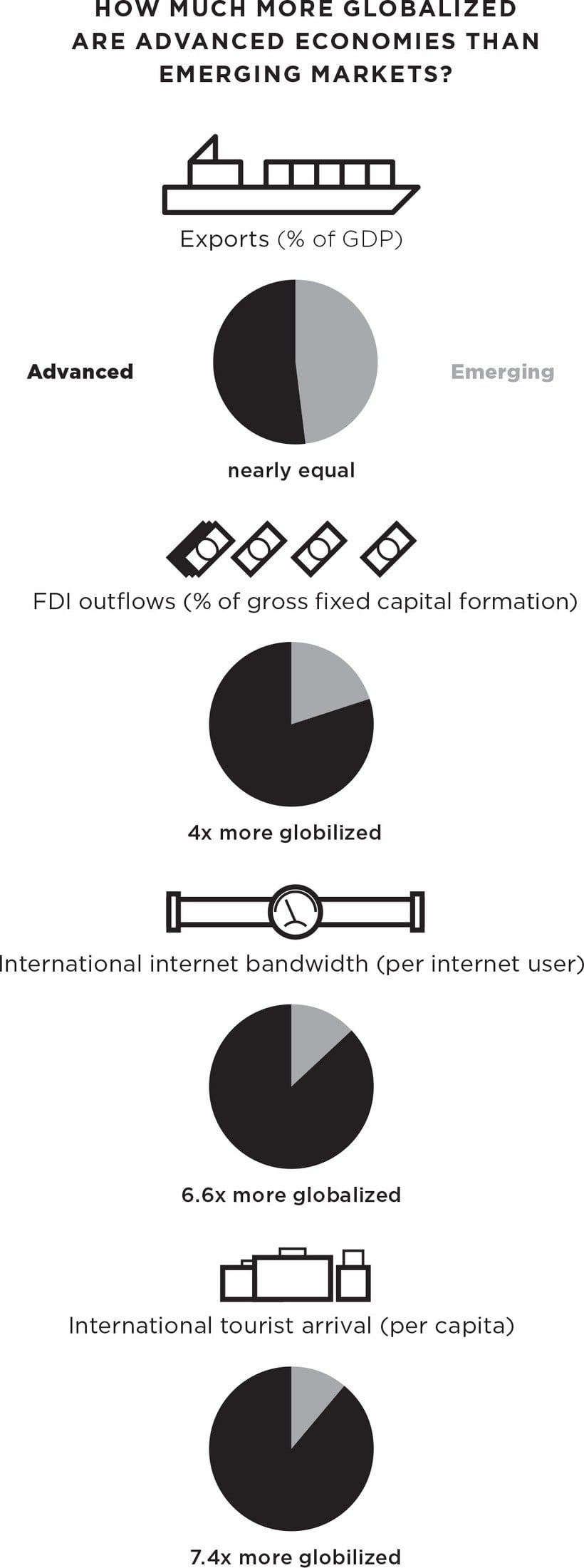

Turning then specifically to the BRICS countries, these large emerging economies rank near the bottom of the index, but that result should not be viewed with as much alarm as one might initially suppose. Large economies tend to have a higher proportion of their economic activity taking place within their national borders rather than spanning across them. Also, emerging economies generally tend to be less globalized than advanced economies: they trade about as intensively, but are only one-quarter as tied into international capital and people flows and one-ninth as connected to international information flows. Nonetheless, the BRICS countries’ results generally do indicate very substantial untapped opportunities for this group of economies to strengthen and benefit more from globalization.

Turning then specifically to the BRICS countries, these large emerging economies rank near the bottom of the index, but that result should not be viewed with as much alarm as one might initially suppose. Large economies tend to have a higher proportion of their economic activity taking place within their national borders rather than spanning across them. Also, emerging economies generally tend to be less globalized than advanced economies: they trade about as intensively, but are only one-quarter as tied into international capital and people flows and one-ninth as connected to international information flows. Nonetheless, the BRICS countries’ results generally do indicate very substantial untapped opportunities for this group of economies to strengthen and benefit more from globalization.

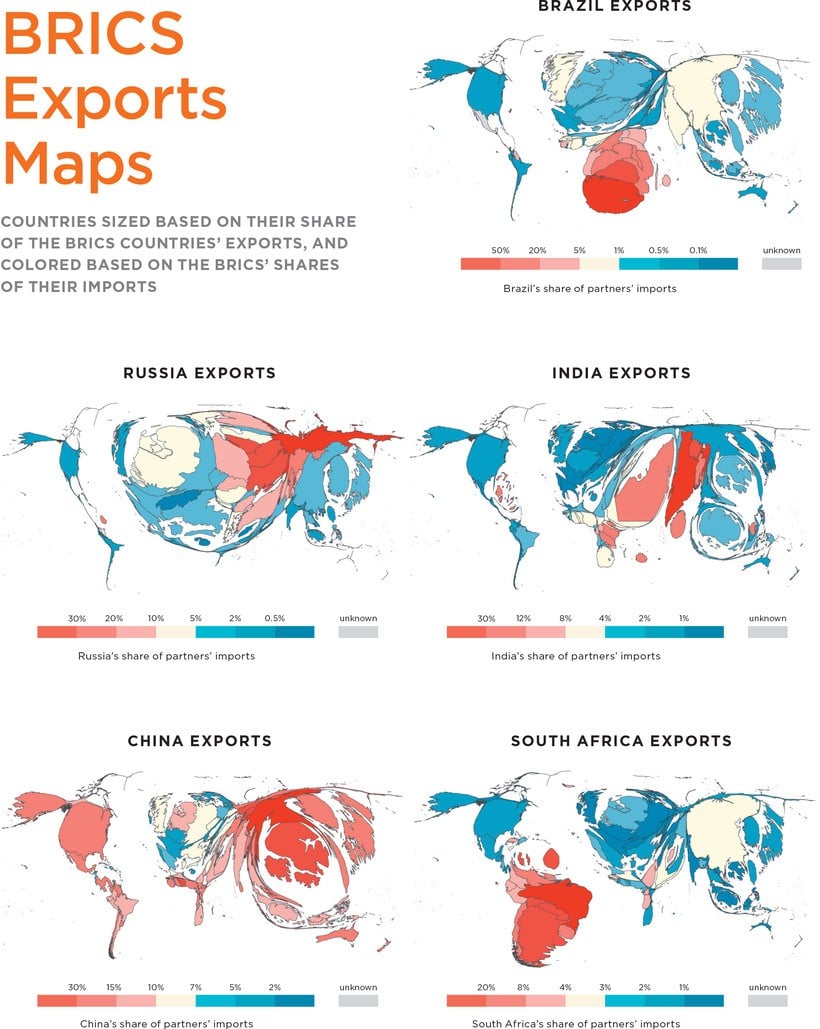

Brazil ranks 130th out of 139 countries on this year’s depth index, which is unchanged from the previous year. But beyond that, there are three key findings worth noting. The country performs very poorly on the people pillar and is substantially below average on the information pillar. Also, Brazil ranks last in the world on trade depth: Merchandise exports and imports each account for only 10% of the country’s GDP.

Contrast this with Russia, which derives 26% of its GDP from merchandise exports (more than twice as much as Brazil) and continues to run a trade surplus equal to about seven percent of GDP – half the levels of 2005/6, but still substantial. Russia also performs marginally better than the others on capital. However, inbound FDI is a particular area of weakness for Russia. Among the 39 countries analyzed in the European region, Russia ranks last (95th out of 139 countries on this year’s DIG).

India ranked 123rd out of 139 countries worldwide (eighth out of 12 in the South & Central Asia region). Performance was marginally better on the capital pillar than on the other pillars although, even there, India ranked very low in terms of inbound FDI. The region in which India is located, South & Central Asia, averaged the second-largest increase in depth scores from 2011 to 2012, with its gains driven by the information and capital pillars. However, the region averaged the lowest scores on the DIG.

Even experienced international business leaders tend to overestimate the depth of trade, capital, information, and people flows by three times or more. The share of the world’s population who are first generation immigrants, for example, is only three percent – the same as it was in 1910!

The intensity of Brazilians’ and Indians’ phone calls to the US is

roughly 90 times the intensity of their calls to China, and South

Africans call the UK at about 150 times the intensity they call Indians!

While the BRICS countries share some economic similarities as the

world’s largest emerging economies, other differences continue to pose

challenges to building up direct informational links among them

The intensity of Brazilians’ and Indians’ phone calls to the US is

roughly 90 times the intensity of their calls to China, and South

Africans call the UK at about 150 times the intensity they call Indians!

While the BRICS countries share some economic similarities as the

world’s largest emerging economies, other differences continue to pose

challenges to building up direct informational links among them

China fared only slightly better, ranking 122nd (17th out of 19 in the East Asia & Pacific region), unchanged from last year. The country ranks particularly poorly on people and, to a lesser extent, trade flows, but does relatively better on capital flows. On both trade and FDI, China ranks more highly on outward flows than inward flows. That said, the country has rebalanced its trade significantly: exports are down from 36% of GDP in 2006 to 25% of GDP in 2012, and the merchandise trade surplus from seven percent to three percent of GDP over the same period.

South Africa, the smallest of the BRICS, ranked the highest among them: 83rd overall (eighth out of the 29 countries analyzed in the Sub-Saharan Africa region). Its performance is relatively stronger on the capital pillar, where it holds the 33rd position out of 116 countries and, in particular, ranks in the top quartile on both inward and outward portfolio equity stocks, behind only Mauritius in the Sub-Saharan region in this regard. And it is comparatively weak on trade depth.

The common untapped potential for the BRICS countries to participate more in globalization is reflected in a comparison of their actual scores to estimates of their expected scores based on structural factors such as their populations, GDP per capita, etc. All four of the larger BRICS countries’ actual scores fall short of their expected scores. Brazil’s shortfall is the largest, followed by Russia’s. India and China’s results are much closer to what one would expect given their structural conditions, with China almost matching the model’s prediction. South Africa is the exception to the rule; its actual depth score is slightly higher than the score expected based on its structural factors.

In addition to subpar depth scores overall, the BRICS countries also have significant potential to improve connectedness with each other – which continues to be limited except in terms of merchandise trade. For instance, the intensity of Brazilians’ and Indians’ phone calls to the US is roughly 90 times the intensity of their calls to China, and South Africans call the UK at about 150 times the intensity they call Indians! While the BRICS countries share some economic similarities as the world’s largest emerging economies, other differences continue to pose challenges to building up direct informational links among them.

Despite stalled globalization in 2012, recent downward global growth forecast revisions, and the low depth scores of the BRICS countries, the outlook for globalization is not bleak. The world economy is still projected to grow faster between 2012 and 2018 than in the 1980s, the 1990s or the first decade of this century. This implies that the largest threat to globalization actually comes from policy fumbles rather than macroeconomic fundamentals. If policymakers make the right choices, the potential for greater globalization – and greater prosperity – can become a reality.

Pankaj Ghemawat is Anselmo Rubiralta Professor of Global Strategy at IESE Business School and Distinguished Visiting Professor of Global Management at Stern School of Business, New York University. Between 1983 and 2008, he was on the faculty at the Harvard Business School where, in 1991, he became the youngest person in the school’s history to be appointed a full professor.