Respite for the Developing World

For the BRICs, it has been a tough few years. Most of these economies are in recession and EM economies are slowing across the board. Their currencies have been pummelled by the collapse in commodity prices and dragged down by a surge in capital outflows. Emerging market equities, once the darlings of investors looking for high-growth, high-risk stocks, are moving out of favour, as they now look like high-volatility, high-risk stocks. The Fed’s recent decision at the FOMC meeting on 17 September to defer a ‘normalization’ of US monetary policy seemed to stem from worries about adverse ‘international developments’, which is Fed code for China. Indeed, China is at the maelstrom of the EM downturn.

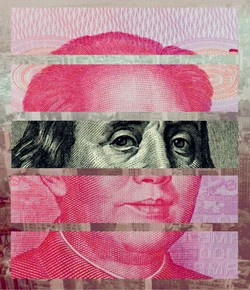

China, the world’s second biggest economy, is slowing and is also close to a recession despite cuts in interest rates and 11 August’s ‘devaluation’. The policy reversal comes after a period in which its currency appreciated relative to that of the rest of the world. The ‘go-go’ years of double-digit, investment-led growth facilitated by a credit boom and massive fiscal stimulus certainly saved the global economy from collapsing into a depression in 2007 and 2008. Chinese authorities want to move to a consumption-led growth model, but the build-up of excess capacity is having a deflationary effect, putting an abrupt end to the commodity super-cycle.

Having accumulated the world’s largest foreign-exchange reserves courtesy of a previously under-valued exchange rate, China is now decreasing its reserves, and as a result, reducing its holdings of US Treasuries. However, rather than forcing up US Treasury yields, the deflationary effect emanating from China is more dominant, and market-based measures of inflation expectations are actually declining, thus effectively capping the upside for core government bond yields. It also effectively places a cap on the US dollar despite widespread market expectations that the US dollar was set for a period of sharp appreciation. This might turn out to be good news for EM markets; twice before, Fed tightening cycles and a strong US dollar have been associated with EM financial crises (Latin America, 1979-1982; Asia, 1994-1997). So if, contrary to market expectations, we are in for a period of low US rates and a soft US dollar, this will give EM policymakers breathing room.

China, the world’s second biggest economy, is slowing and is also close to a recession despite cuts in interest rates and 11 August’s ‘devaluation’. The policy reversal comes after a period in which its currency appreciated relative to that of the rest of the world. The ‘go-go’ years of double-digit, investment-led growth facilitated by a credit boom and massive fiscal stimulus certainly saved the global economy from collapsing into a depression in 2007 and 2008. Chinese authorities want to move to a consumption-led growth model, but the build-up of excess capacity is having a deflationary effect, putting an abrupt end to the commodity super-cycle

The slump in the Chinese stock market was a classic credit-fuelled bubble, one which followed hot on the heels of the bursting of the Chinese property bubble. As we know, in the West, when credit-fuelled bubbles burst, the consequence is usually a long-lasting recession and an impaired banking system. Perversely, there are indications that the monetary stimulus enacted this year is resuscitating a repeat property market bubble in China.

China accounted for 35-40% of global GDP growth last year. It is the world’s second biggest economy, the world’s biggest commodity importer, and home to the world’s largest banks. The impact from the downturn of the Chinese economy is already being felt far and wide, especially on commodity exporters ranging from Brazil to Australia. So China matters.

While the recent backdrop does not make for encouraging reading, we should try and avoid getting caught up in short-term market ‘noise’. Face-to-face dialogue is crucial in these times for the global economy. It has never been more important for investors to investigate the reality behind often-alarmist news headlines. Economic fora such as VTB Capital’s annual Russia Calling! Investment Forum are vital in this respect, bringing together foreign investors, CEOs, government officials, business leaders, and journalists – all the Russian economy’s key players. Of course, these events plant the seed for many important business deals. But the most valuable outcome will always be achieving a shared understanding of the major issues impacting the global economy, as well as a shared resolve in how to approach them.

Part of my summer holiday reading was Peter Frankopan’s excellent The Silk Roads: A New History of the World. The opening sentence begins, “From the beginning of time, the centre of Asia was where empires were made.” It was not the West – though there is an argument that Portugal, rather than Spain or Great Britain, created the first truly global empire. No matter, for many EM economies, demographics and resource availability are in their favour. This is where global growth will be located. The centre of gravity for the global economy has already shifted to the East.