Wire Transfer Economy

Every year, Latin Americans working in the United States wire tens of billions of dollars back to their home countries. Unfortunately, these enormous resources are not used very efficiently. Irrational financial behavior seems to be one of the main culprits

This conclusion was reached by the Multilateral Investment Fund (MIF) of the Inter-American Development Bank following a survey of 2,000 Latin American migrant workers living in the five largest US cities. The main conclusions of the survey, “Economic Status and Remittance Behavior Among Latin American and Caribbean Migrants in the Post-Recession Period,” could be summarized as follows:

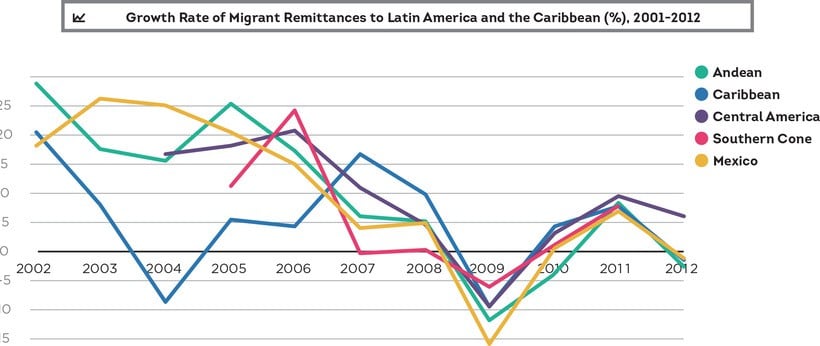

Cross-border remittances going to the eight countries included in the survey – Colombia, Dominican Republic, El Salvador, Guatemala, Haiti, Honduras, Jamaica, and Mexico – have grown by 12% since 2009. According to the MIF, economic conditions for migrant workers have improved to some extent, although their situation still remains vulnerable in terms of income, savings, and debt levels.

Even though two-thirds of those polled by the MIF confirmed that they maintained savings, the vast majority of migrants did so informally, thereby missing out on the opportunities, products, and services offered by modern banking. Furthermore, nearly 60% of those polled stated that they did not have a bank account in the United States. Only every third recipient of these remittances back home appears to have a bank account.

Experts from the MIF believe that these behavioral stereotypes significantly undermine both the financial sustainability of Latin American migrant workers in the United States and the prospects of improving their well being in the long-term. They also negatively affect the financial standing of their families, communities, and entire regions of their home countries, for which these remittances are the main source of income. Needless to say, this money could be used more effectively to reduce poverty, boost regional development, and enable the recipients to better invest in their health and education, as well as improve their housing conditions and businesses.

A shift in behavioral stereotypes should become a state policy objective. After all, the amount of money at stake is huge – in 2012, Latin American migrant workers in the United States accounted for more that $61 billion in wire transfers back to their home countries.