Emerging advantage

Few people know the emerging markets as well as he does. And few people have made as much money as he has, from investing in the BRICS countries. Mark Mobius, executive director of Templeton Emerging Markets Group, granted BRICS Business Magazine an exclusive interview, analysing the investment attractiveness and prospects of each of the BRICS countries.

I was initially attracted to emerging markets when I began my career as a global investor and have continued to find them both fascinating and rewarding for over 40 years. Emerging markets offer a pool of investment opportunities in terms of companies with high growth potential. Our investment philosophy at Templeton Emerging Markets Group is built upon a disciplined yet flexible, bottom-up approach to long-term, value-oriented emerging markets investing.

Emerging markets, BRICS countries (traditionally Brazil, Russia, India, and China [to which I would also add South Africa]) included, now represent about a third of the world’s stock market capitalization. Moreover, this year average growth rate for emerging markets is expected to be around 5% versus 1% in developed countries according to IMF projections. Given good growth projections, generally better debt-to-GDP ratios and higher foreign reserves than many developed countries, these markets should do well in the long-term. Domestic demand—driven by rising incomes and the maturing of a young working population—will also play an integral role in emerging countries’ growth.

We believe the BRICS nations have a better economic outlook right now than many developed economies, which are still weighed down by sluggish growth and debt. The investment community fears that emerging markets will see growth weaken in the future rather than strengthen. However, there are good reasons to remain optimistic about the prospects of the BRICS countries.

Brazil

Brazil remains an attractive investment destination for long-term investors despite slowing domestic growth and uncertainty in the global economy. However, its competitive position is at risk of slipping as a result of the heightened economic challenges the country has experienced since the beginning of 2012. In 2011, Brazil’s growth eased to 2.7% after having reached 7.5% in 2010. The Eurozone crisis and the impact of a stronger Real on the competitiveness of Brazilian industry are partially to blame for this slowdown.

The BRICS dossier

Mark Mobius is a global investor and manager, one of the biggest and most influential investors to specialise in the developing markets. In 30 years of investments in the companies of the developing countries, he has won a multitude of prestigious awards, including the Best Emerging Markets Equity Manager, Closed-End Fund Manager of the Year, Investment Trust Manager of the Year and many others. In 2006 Asiamoney magazine placed this international financier on its list of Top 100 Most Powerful and Influential People.

He admits that he spends most of his time—250 days each year—on the road, and has already visited companies in virtually every corner of the planet. “After chalking up over 30 million miles of flight time, I’m proud to achieve the status of a full-time nomad. I would rather see with my own eyes what’s happening in a company or country,” he writes in his blog.

Moreover, Mobius has penned several books, including Trading with China, The Investor’s Guide to Emerging Markets and Passport to Profits.

However, Brazilian policymakers are paying attention to these challenges and appear to be steering the economy in the right direction. The Central Bank has cut its key interest rate in a continued effort to stimulate the domestic economy, has stepped up intervention in the foreign exchange market to help push the Real lower, and has tightened capital inflow controls. Brazil’s government has also taken a number of actions to support export of manufactured goods. The upcoming 2014 FIFA World Cup and 2016 Summer Olympics as well as the government’s plans to invest $65bn in infrastructure development provide reasons for investors to remain positive on the country’s development.

Emerging markets now represent about a third of the world’s stock market capitalization

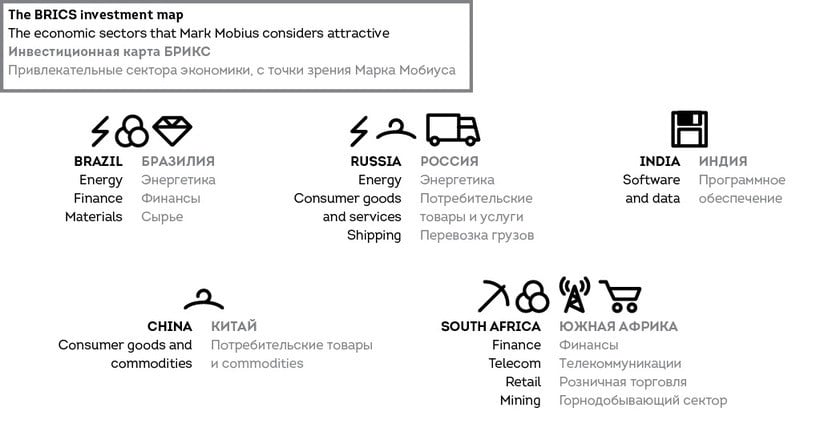

My research team and I continue to like the long-term investment potential of Brazil. In particular, we like the energy, financials and materials sectors, while rising incomes and higher living standards of a young, working population have the potential to drive domestic consumption. Should these trends continue, Brazil’s sluggish growth may turn into a growth spurt in the future.

Russia

We think Russia has evolved a great deal as an investment destination in the past two decades and holds great potential, although there is still more work to be done to open the markets and instill investor confidence. In the first quarter of 2012, Russia was the only BRICS nation to experience acceleration in GDP growth from the prior quarter (to 4.9% from 4.8%). Russia also boasts enviably low levels of leverage in its economy; its debt-to-GDP ratio was 8.7%1 in 2011 and domestic credit as a percentage of GDP was 45.9%. It also has coffers of $500bn in foreign reserves and is a major global producer of many commodities, including energy and precious metals.

Energy is, of course, extremely important to Russia, representing about three-quarters of its exports. Russia is the world’s largest producer of crude oil, churning out some 10 million barrels per day, representing about 12% of the world’s oil.2 It also holds the world’s largest natural gas reserves and second-largest coal reserves. As such, energy companies account for a big part of the country’s market. While [President] Putin has pledged to diversify Russia’s economy and draft budgets that are less reliant on oil tax revenues, Russia’s future is still largely dependent on oil prices. Volatility in the price of oil, therefore, also contributes to volatility in the Russian stock market. Turmoil in Europe (and the prospect of slower growth elsewhere this year) contributed to oil price declines this spring and summer, but our team doesn’t anticipate a dramatic fall in oil prices.

This year average growth rate for emerging markets is expected to be around 5% versus 1% in developed countries according to IMF projections

From an investment standpoint, we look for opportunities across the energy sector, including companies that engage in exploration, production, refining and marketing. We are also looking for opportunities in areas including consumer goods and services, and shipping. Rail-container shipping is an area which we believe should see growth aided by increasing consumer demand, a potential improvement in the global macro-economy, and development of the country’s Europe-Asia transit potential.

India

Investors’ main concerns related to India are the lack of reforms and the corruption scandals around misuse of public resources. Over the past year however, fierce protests in India have provided impetus for change and pushed corruption to the top of policymakers’ agendas. I am more optimistic than most that India will eventually be able to put some of these high-profile scandals behind it. The power of the media, the Right to Information Act, and the increasing use of information technology in delivering public and private services should help reduce corruption in public and private transactions in India. I believe there are a number of needed reforms, but we are optimistic the country will find a way to work through these challenges.

Despite the problems that India is currently facing, we are expecting at least a 4–5% growth rate for 2012, which is again very rapid growth. Increased predictability for the business environment can also foster a change in the investor sentiment. I choose to continue to look for long-term investment opportunities in India. If India is able to engage in meaningful reform, I can see the potential for growth rates there that could echo what China experienced 5–10 years ago. I think India’s vast natural resources and current positive (if uneven) trends of a growing middle class, GDP growth and domestic hunger for consumer goods hold opportunity for the diligent investor. In terms of sectors, we see opportunities in India in the software and data sectors.

China

There is a great deal of concern regarding a slowdown in China’s economy. It is true that China’s growth is decelerating from the double-digits of recent years to a possible GDP growth range of 7–8% this year, but this should by no means be considered a hard landing and still represents an impressive pace.

There is a great deal of concern regarding a slowdown in China’s economy. It is true that China’s growth is decelerating from the double-digits of recent years to a possible GDP growth range of 7–8% this year, but this should by no means be considered a hard landing and still represents an impressive pace.

We expect the Chinese economy to continue to grow 7–8% annually for the foreseeable future. There could be some fluctuations, but in general we believe that this level is sustainable. China may be growing at a slower pace, but it is slowly becoming less dependent on exports and investment for its growth and investors should be happy to see that happen.

Another reason to remain positive on China’s economy, in our opinion, is its demographics. Its labor force is still very competitive compared to that in the developed world. Moreover, there are a lot of reforms that the government can implement to improve productivity, e.g. cutting business taxes, privatization of more state-owned enterprises or liberalization of its interest rate market to help small and medium enterprises.

We have viewed the angst-inspired market setbacks as potential opportunities and price-earnings ratios are generally looking attractive to us in China right now. Consumers and commodities are particular areas of interest, because we believe a transition to a more consumption-based economy should help support these sectors.

South Africa

South Africa stands out among its African peers with a large and liquid equity market. Moreover, a number of South African companies provide exposure to markets further north that might be difficult to secure locally. Mining stocks have attracted investors to South Africa in the past but recent labor problems in that sector will impact earnings and performance if coordinated reforms are not made by both the industry and government. It still remains an important sector and bears continued monitoring. What is more interesting now is the consumer sector and companies impacting the consumers such as consumer banks and insurance companies as well as telecoms companies. The retail sector is of particular interest with special emphasis on those firms moving northward into the rest of Africa. Some of the investment challenges related to liquidity and general transparency are less of a problem in South Africa than in other African markets.

South Africa stands out among its African peers with a large and liquid equity market. Moreover, a number of South African companies provide exposure to markets further north that might be difficult to secure locally. Mining stocks have attracted investors to South Africa in the past but recent labor problems in that sector will impact earnings and performance if coordinated reforms are not made by both the industry and government. It still remains an important sector and bears continued monitoring. What is more interesting now is the consumer sector and companies impacting the consumers such as consumer banks and insurance companies as well as telecoms companies. The retail sector is of particular interest with special emphasis on those firms moving northward into the rest of Africa. Some of the investment challenges related to liquidity and general transparency are less of a problem in South Africa than in other African markets.

Conclusion

We believe the BRICS markets retain strong characteristics that attract equity investors. We can count here a strong economic growth, favorable demographics, rich natural resources, and strong finances. The worries and uncertainty will likely continue to create some angst in the global market, which could spill over into emerging markets, including BRICS countries, but we firmly believe that these markets should do well in the long-term. Emerging countries’ abilities to balance growth, inflation and global competitiveness will be a crucial factor in this. Even if their overall growth this year may be a little lower than in recent years, most of these economies are still expected to grow faster than those of developed nations.