New leaders, old risks

The banks of the BRIC countries are gaining more and more traction in the global financial system, and this means that their risks are worthy of the closest scrutiny. A research by SKOLKOVO Business School – Ernst & Young Institute for Emerging Markets Studies (IEMS) has shown that the greatest such risks are real estate loans, excessive state influence and falling economic growth rates.

Now big enough to fail

In 2008, rating agencies proved unable (or unwilling) to take notice of the growing risks of major US and European banks, and thus failed to avert disaster. Now IEMS proposes focusing special attention on other financial institutions, as the post-crisis era has seen rapid growth of banks in countries with rapidly developing markets (RDM). These banks became the subject of the study “The risks of BRIC banks in a world of risks.”

If, for most developed economies, recovery from the world banking crisis is still a challenge, the RDM banks—those of Brazil, Russia, India and China — escaped relatively unscathed. Therefore, there were fewer collapses of leading credit institutions in BRIC countries than in developed countries.

As a result, the importance of BRIC banks in the world banking system is rapidly growing. According to the Bloomberg news agency, in 2011 forty-four of the 100 biggest banks in the world came from emerging market countries, while in 2002 and 2007 this figure was just 21 and 30 respectively. For this reason, it is particularly important to assess the resilience of banks in BRIC countries, in order to be ready to face the possible risks and benefits, note experts.

New skyscrapers emerge in Hong kong at a pace comparable with that of the regional stock market’s growth

China is stabilizing while Russia takes risks

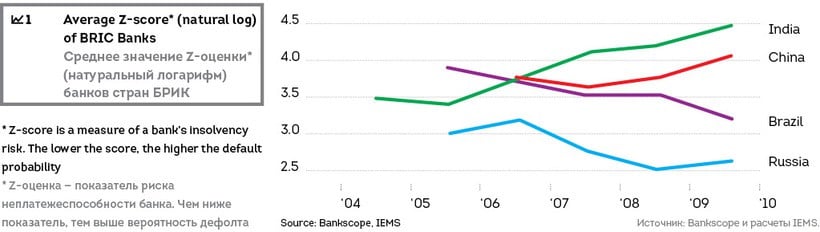

On the whole, the largest banks in China and Brazil have gained greater stability (the risk of their insolvency is falling), while the largest Russian lenders have become less sound. In India, the dynamics have not been consistent, according to the study.

The levels of risk associated with individual banks in the BRIC countries mainly reflect the economy of their host country. A high rate of economic growth helps reduce the risk of bank insolvencies. China and India achieved far higher annual real GDP growth rates in 2005–2010 (on average, 11.22% and 8.54%, respectively) than did Russia and Brazil (4.09% and 4.2%). Apparently, this is the main factor behind the upward growth trend for stability in the Indian and Chinese banking sectors, while Russia and Brazil demonstrate quite different trends.

The size of each national economy also heavily influences the level of risks of BRIC banks. All other conditions being equal, banks lean toward aggressive expansion and risk-taking when active on larger markets.

It is clear that in addition to macroeconomic factors, a bank’s own structure may influence the way banks make decisions that involve risks. Experts have concluded, for example, that publicly listed banks are more stable. This is probably a result of pressure from new shareholders. A number of lenders in the emerging markets have conducted IPOs in recent years, which helped them to reduce the risk of insolvency.

One of the most interesting conclusions in the study claims that systemically important banks in fact have a greater appetite for risk. Within the current regulatory systems of most of the emerging-market countries, the state extends to systemically important banks an indirect guarantee of their solvency (the “too big to fail” doctrine was operational on Wall Street for some time). This drives the management to even more aggressive risk-taking.

Experts analysed 12 systemically important banks in the BRIC countries (3 in Brazil, 2 in Russia, 3 in India and 4 in China), and assessed how robust they were.

Russia: lucrative but dangerous liaisons

In Russia, there are two systemically important banks: Sberbank and VTB. In 2010, these two could boast 23.54% and 11.71% of all the bank assets in the federation respectively. Both banks belong to the state, with the level of direct state ownership reaching 57.58% (via the Bank of Russia) and 85.5% (via the Federal Agency for Management of State Property).

Successful SPO

Sberbank had its long-awaited SPO in mid-September, in which 1.7bn or 7.6% shares went private. Proceeds of the deal organised by Credit Suisse, Goldman Sachs, J.P.Morgan, Morgan Stanley and Troika Dialog exceeded $5bn. According to sources, selected funds invested upward of $1bn including the famous George Soros.

Sberbank offered investors a great opportunity to acquire an attractive asset at a good price as the stock was selling at a 1.4% discount. There was no shortage of those who eagerly jumped at the opportunity to the point that the bid book was oversubscribed more than twofold. The bank allocated nearly $650m for a potential buyback but never had to put this money to use.

As the leading banks in Russia with state sponsors, they possess unquestionable advantages compared to other players in the field. For example, Sberbank is the only creditor in Russia to enjoy a state guarantee for bank deposits. Compared to their competitors, Sberbank and VTB have control of relatively cheap and stable private deposits, and can obtain fast access to state financing resources, which allows them to hold less excess liquidity.

Such a strong link with the state can have a positive effect on the profitability and stability of these two “pockets” of the Russian state. On the other hand, they are obliged to service certain state programs, which can include extending, by government request, emergency financial aid to other, smaller banks encountering financial difficulties. As a result, the level of risk assumed by these giants reflects not only their own strategic risk-taking decisions, but also the stability of the entire Russian banking sector.

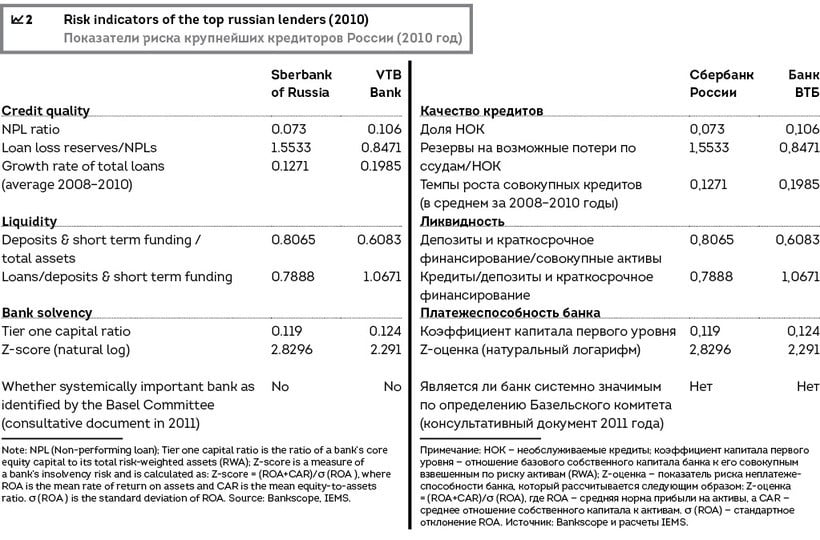

Table shows certain key risk parameters of the two companies in 2010. As the largest and most prestigious creditor in Russia and Eastern Europe, Sberbank demonstrates higher credit quality, more cautious behaviour in forming reserves to cover possible losses on loans, and a higher level of stability (or a lower risk of insolvency) than VTB. However, more recently, the quality of the bank’s assets have deteriorated fairly rapidly.

Overall, Russia’s two leading lenders have responded positively to the emergency measures implemented by the government to support systemic stability. As is well known, these measures mainly helped larger banks.

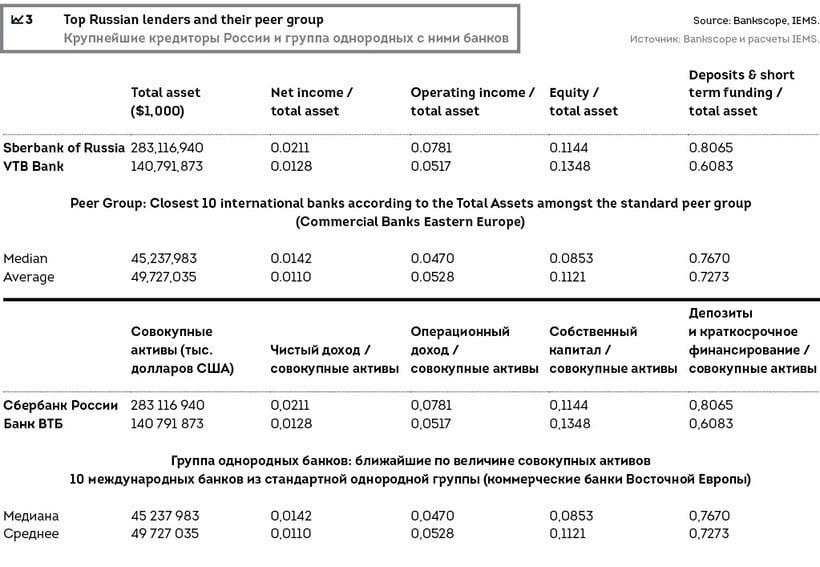

Although the Basel Committee does not yet consider them to be “global systemically significant banks”, they have been transformed into the largest lenders in Eastern Europe, which indicates the contrast between these two companies and the ten international commercial banks in the region with the next highest aggregate assets.

In 2012 Russia joined the WTO, so in the future the country’s banking market and its leading banks, most likely, will become more international, and will be more closely integrated into the world market. As a result, the influence of Russia’s two largest lenders on the regional banking market can only increase.

China’s Big Four overloaded with real estate

In China, four of the largest systemically significant creditors (the Big Four) are the Industrial and Commercial Bank of China (ICBC), the China Construction Bank (CCB), the Bank of China (BOC) and the Agricultural Bank of China (ABC). In 2010, these four could boast 15.39%, 12.36%, 11.97% and 11.82% of all the bank assets in the country.

All of these institutions are state commercial banks with direct state ownership amounting to an average of 70% of capital, and for this reason they are heavily influenced by the Chinese government.

Compared to the largest creditors in other BRIC countries, over the last ten years the Big Four have undergone the most far-reaching changes from the viewpoint of both financial results and the insolvency risks. However, since 2003 positive trends have been evident, with the volume of operations constantly growing both in assets and deposits. More than this, the Big Four’s position on capital has become more robust, when compared to 2003.

Due to restrictions introduced by national regulations, ICBC, CCB, BOC and ABC perform far fewer types of high-risk activity, compared to similar banks in other BRIC countries.

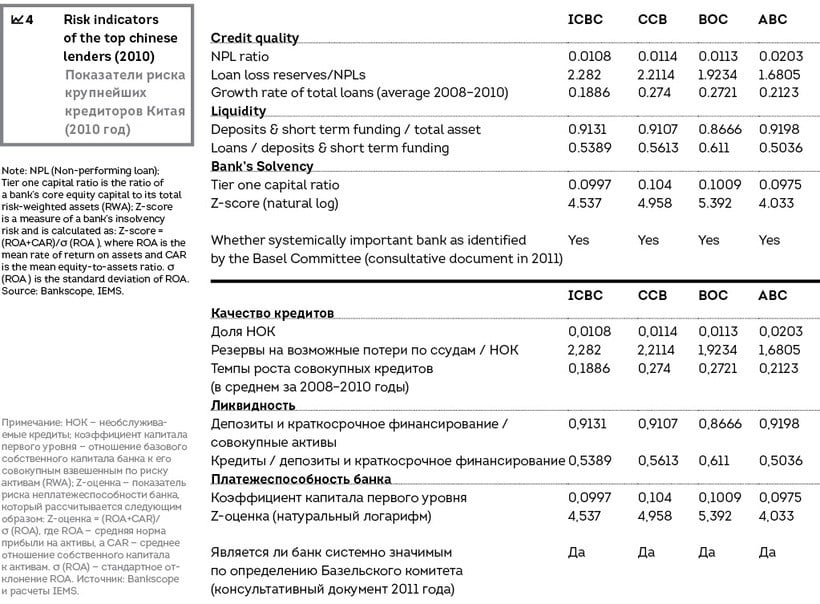

Table shows the main risk parameters of China’s Big Four banks. Compared to the largest lenders of other BRIC countries, the Chinese giants are showing a higher level of stability.

“The most important risk factors, which must be a source of concern for the Big Four, are, it would appear, the heavy political burden and large-scale interference by the state,” notes the study. “The government often renders significant pressure on the decisions of these banks to offer credits, and manipulates them directly.”

After the global financial meltdown of 2008, the government of China took aggressive measures to stimulate the economy. In order to help the government achieve the selected political goals, the Big Four conducted an extremely liberal credit policy, flooding the credit market with new loans worth more than ¥10bn. Many of these newly-issued loans ended up in the real estate sector. According to a widely-held opinion, since 2006 a real estate “bubble” has been growing in China, and if it bursts the Big Four could find themselves handling numerous dead loans.

The evolution of banks in the Middle Kingdom

China’s Big Four banks were initially specialized, but in the 1990s were transformed into commercial banks. Although they occupied a position of dominance, and they handled a large share of the loans on the Chinese banking market, the financial results of these banks were fairly weak in the 1990s. As a result of “political” loans, extended in the previous years to loss-making state enterprises, these banks were weighed down with a heavy load of debt.

The total capital of these banks was far lower than the mandatory level of capital adequacy (8%), established at that time by the Basel Accords. With the goal of cleaning-up the books of the Big Four, most of the debts were transferred to state asset-management companies.

Moreover, the Chinese government has implemented a special program since 1998, to inject capital into the Big Four. Between 1998 and 2005, the total sum of injections amounted to ¥785bn (or $95bn), the equivalent of 10% of the central government’s revenue. After evacuating dead debts from banks and massively injecting capital into the Big Four, they were made into public companies, whose shares have been listed on the domestic stock markets or the Hong Kong Stock Market since 2005.

The reform of the Big Four was, ultimately, highly successful. These banks were heavily reinforced and over the last few years, even at the height of the world financial crisis, they have been expanding rapidly.

In a consultative document released recently by the Basel Committee, BOC has already been classed as a global systemically significant bank, although it is the only BRIC credit institution on the list. Therefore, the ability of China’s Big Four to underpin their stability and resilience in the post-crisis era will have a major impact on the overall stability of the world banking market.

The banks of India and Brazil: small but successful

Compared to other BRIC countries, the banking sector of India is fairly heavily fragmented, and has no clear leaders. Three commercial banks in India—the State Bank of India, ICICI Bank and Punjab National Bank—together held 26.67% of India’s total banking assets in 2010 (17.12%, 5.54% and 4.01% respectively).

Generally speaking, India’s rapid economic growth in recent years has had a strong positive influence on the three largest credit institutions in the country, and the risk of their insolvency is relatively low. At the same time, their influence on the international banking market is not yet significant.

In Brazil, there are three leading banks: Banco do Brasil, Itau Unibanco Holdings and Banco Bradesco. Their market shares are 10.44%, 9.72% and 8.2%, respectively. All three companies showed enhanced financial stability in the years 2006–2010, which was facilitated by dynamic growth of the country’s economy and a boom on the commodities markets over the same period.

These institutions are well capitalized, with tier 1 common equity greatly exceeding the mandatory minimum (11%, 11.8% and 13.1%, respectively).

Three threats for BRIC banks

The study reviews a total of 142 BRIC banks. This allowed experts to identify the key risks that threaten the financial systems of these states.

troubles with obtaining credit have prompted the developer of this gambling project in Macau to partly halt the construction

One of these, notoriously, is real estate, which already led to collapse four years ago. “A common denominator of the largest BRIC credit institutions is the rapid growth in their credits over recent years, especially in the real estate sector,” observe the experts. “This could become the main driver behind expanded bank risk in BRIC countries over the next 2–3 years.” This problem is especially acute for China, and the country’s regulatory agencies should pay close attention to possible deterioration of the quality of credits held by the leading Chinese banks in the near future, recommends the study.

One of these, notoriously, is real estate, which already led to collapse four years ago. “A common denominator of the largest BRIC credit institutions is the rapid growth in their credits over recent years, especially in the real estate sector,” observe the experts. “This could become the main driver behind expanded bank risk in BRIC countries over the next 2–3 years.” This problem is especially acute for China, and the country’s regulatory agencies should pay close attention to possible deterioration of the quality of credits held by the leading Chinese banks in the near future, recommends the study.

The second risk is the state. A significant share (75%) of systemically significant banks in BRIC countries are state-owned. Although state ownership helped stabilize the financial sector during the global crisis, policy makers must understand that in normal conditions non-state banks must play a more substantial role in developing an internationally competitive and financially stable sector, warn the study’s authors.

And, finally, the most widely-shared threat is a deterioration of the macroeconomic situation. Thanks to rapid economic growth, the BRIC countries have stable short- and medium-term prospects, from the viewpoint of both the solvency of their leading players, and the sector as a whole. However, a slowing of economic growth could lead to significant increases in the risk of insolvency of banks in the BRIC countries.