The Startup Nation

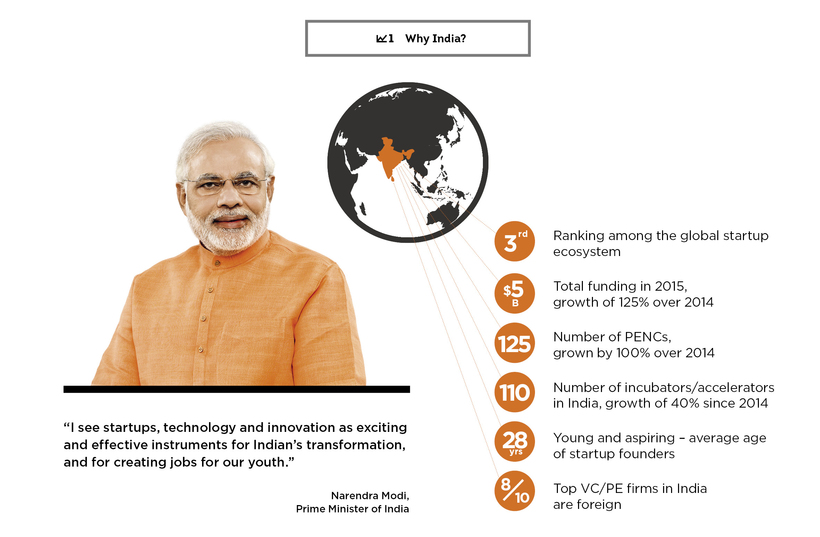

Since the beginning of the current decade, India’s technology startups have demonstrated impressive growth that has already brought the country to third place in the world only behind the acknowledged industry leaders: the US and Israel. This is what the latest NASSCOM-Zinnov report titled ‘Startup India – Momentous Rise of the Indian Startup Ecosystem,’ discusses. NASSCOM Head of Research Achyuta Ghosch offers his insightful look into the roaring Indian startup environment in this article written specially for BRICS Business Magazine.

In today’s India, there are more than 4,200 startups from various fields, including digital (social networks, mobile technologies, analytics, cloud computing), hi-tech (augmented reality, Internet of Things, robotics), and ‘verticals’ where blank spots are identified and solutions are developed for specific areas (education, medicine, finance, advertising). We have covered the special aspects of the country’s start-up ecosystem in our report called “India as a platform for start-ups. A remarkable rise of the Indian startup ecosystem”, which was prepared by the NASSCOM Association and Zinnov, one of the leading consulting companies in the Indian high-tech sector. We are going to introduce our readers to the most interesting findings of our study on the pages of BRICS Business Magazine. Our report focuses on 2015 – a highly successful and, in some ways, landmark year for the Indian startup ecosystem.

The startup ecosystem in India is young, innovative, aspirant, and futuristic, and since the beginning of the decade, it has virtually exploded. To put things in perspective, India had only 480 tech startups in 2010. Tech startups by definition include any business in the domain of technology incepted within the last five years, is headquartered in India, or has founding team with Indian origins along with product development largely in India.

Here are some key highlights of the Indian startup industry – and its emerging hotbeds of innovation:

- 1,200-plus new startups added in 2015;

- 80,000-85,000 jobs created by startups; greater than 10% growth in last year;

- India is the youngest start-up nation in the world – 72% of the founders are less than 35 years old;

- ~ 50% rise in share of female entrepreneurs in 2015 over 2014, driven by 4.5 times the growth in funding to women-driven startups;

- most of these founders, with a strong consumer-centric approach, have come up with some of the best-in-class B2C startups. Women entrepreneurs have also started to leverage the innovation economy;

- funding increased by 125%, from $2.2 billion in 2014 to $4.9 billion in 2015; this is much higher compared to the cumulative funding of ~$3.2 billion over the 2010-14 period;

- ~2.2 times the increase in the number of startups funded in 2015. More than 390 startups have received funding, compared to 179 startups in 2014;

- while overall VC/PE funding has grown by 2.2 times over 2014, seed stage VC funding has grown by an incredible 6.5 times;

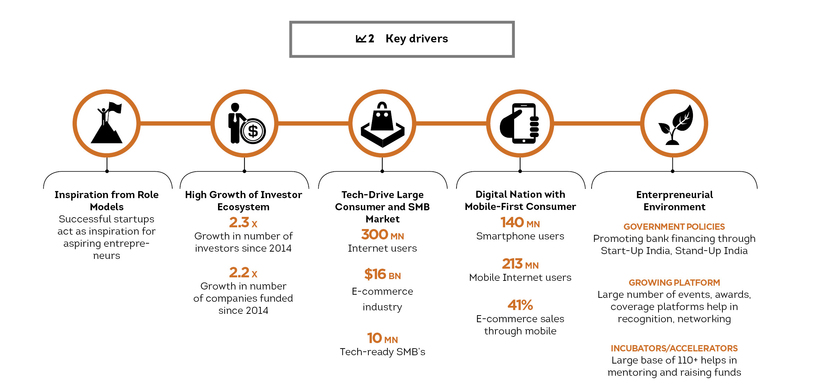

- the total number of active investors has grown by 2.3 times, from 220 in 2014 to 490 in 2015;

- the B2C segment dominates, led by e-commerce, health care and aggregators; B2B funding evolves as e-commerce enablers, IoT, and analytics emerge as focus areas;

- more than 65% of startups are located in Bangalore, NCR, and Mumbai;

- 2.3 times the growth in number of active investors; global investors and corporates are betting high on the India market. Tiger Global, Sequoia Capital, Softbank, Warburg Pincus, and Alibaba are among the top investors, participating mostly in high-value deals worth more than $500 million;

- startups are creating a new world of talent; executives from national and international conglomerates are joining top positions at start-up ventures or starting their own ventures.

Driving the Dream

So what is really driving this dream? Increasingly, the number of investors, including global ones, who are parking funds here; a growing digital user base; mobile-first population; and a supportive government that recognizes the role of startups, are clearly some of the top of mind drivers.

This maturing startup ecosystem is contributing to the Indian economy in multiple ways. In addition to enhancing the lifestyle of citizens, startups are creating innovative technology solutions that address key problems that India as a country faces, and are empowering SMBs by enhancing their customer reach and overall business productivity.

The meteoric rise of tech startups and their contribution is unparalleled. This has much to do with the fact that young entrepreneurs are able to think big, and view India’s challenges as billion-dollar opportunities. Power shortage in India lead to an annual loss of $68 billion); impact of infrastructure congestion is estimated at $10 billion; India only has one doctor for 1700 patients; over 120 million rural households do not have access to bank accounts; agricultural productivity is abysmal in India (48% of agricultural yield compared to other Asian countries); and impact of technology will imply a huge skilling challenge in India, with 500 million people required to be skilled in the next five years. A vision that has captured popular mindshare of the startup community is that these challenges, if addressed, can transform the nation beyond recognition.

It is encouraging to see global investors interested in large deals, upward of $500 million. In the B2C segment, hyperlocal e-commerce and aggregators presently command a lion’s share of the pie. But in the B2B segment, especially those in niche segments and providing solutions to the former, are close on the heels. Robotics, 3D printing, and machine learning are the other emerging whitespaces for the future.

The ecosystem is not just

cognizant but supportive of this change in equal measure. This is

evidenced by the fact that incubators, accelerators, and the like are

mushrooming. The triad – academic institutions, the government, and

corporate houses – provides support to this part of the value chain

admirably, be it physical space or knowledge dissemination. Often, both.

Exits: instilling positivity and confidence

The period from 2014-15 has seen some large exits, instilling positivity and confidence in the investor community. Over 65 acquisitions this year signal a maturing startup ecosystem in India. An improving environment for doing business – these are the main reasons for a rush of venture capital into India over the last two years. Now, there’s another pull factor growing stronger: exits.

Exits, mergers, and acquisitions are important for investors as they help them to reinvest into new startup ventures. Their risk appetite goes up, too, as exits mitigate worries over getting caught up in a valuation bubble. And it is not just the number of exits that matter, but their size, too.

With over 65 M&A deals already in 2015 – worth close to $800 million (which excludes several deals with undisclosed value), – India has shown the signs of positivity and confidence in the global market. More importantly, some of these have been big-ticket exits instilling investor confidence in the Indian startup ecosystem.

Thanks to active government support and the

building of the necessary infrastructure, in particular as part of the

Start-Up India program, the country’s startup industry is growing at an

impressive pace. By 2020, more than 11,500 tech startups would get

established in India, generating employment opportunities for over

250,000 people. Key indicators, such as opportunities existing in the

domestic market, access to capital/mentors, increased M&A and

consolidation activities, and the increasing digitalization of India

clearly point toward the further evolution of the ecosystem.

START UP INDIA, STAND UP INDIA

Catalyzing the entrepreneurial journey

• allow self-certification for labor and environment laws – startups can self-certify labor laws, and no inspections will be conducted for a period of three years;

• create a single platform (in the form of a mobile app and portal) with a list of all compliances for setting up a company, tracking the status of the registration application, application process for various schemes of the Start-up India Action Plan and collaborating with various startup ecosystem partners;

• focus on intellectual property – fast tracking of applications, panel of facilitators to help and advise, 80% rebate on filing of application for IPR;

• make it easier for startups to wind up operations – the 2016 Insolvency and Bankruptcy bill that ensures the time-bound settlement of insolvency, enables faster turnaround of businesses, and creates a database of serial defaulters, has been passed.

Coaching, mentoring, and incubation

• launch of Atal Innovation Mission (AIM) with Self Employment and Talent Utilization (SETU) program – establish sector specific incubators in PPP mode, establish 500 tinkering labs, pre-incubation training, strengthening of existing incubation facilities, seed funding to successful startups;

• build Innovation Centers at National Institutes – setup 13 startup centers, with funding for student driven startups, set up 18 technology business incubators at NITs/IITs/IIMs;

• set up seven new research parks at IIT Guwahati, IIT Hyderabad, IIT Kanpur, IIT Kharagpur, IIT Gandhinagar, IIT Delhi, IISc Bangalore, with an investment of 100 crores ($18.5 million) each.

• encourage entrepreneurship in Bio-technology – have 2,000 startups in India by 2020;

• foster a culture of innovation in the field of science and technology among students – target 10 lakh (1 million) innovations from five lakh (500K) schools;

• create seven world-class incubators – identify the best incubators in India and support them with grants of 10 crore ($1.85 million) each.

Capital, credit, and tax breaks

• establish a fund of funds, with a corpus of 10,000 crores ($1.85 billion) – 2,500 crores ($463 million) per year over four years; provide credit guarantee to startups, to enable flow of venture debt to new ventures; tax exemption on capital gains for investors, if the capital gains is either (a) invested in the government’s fund of funds or (b) used for purchasing new assets in technology-drive startups;

• startups will be exempted from income tax on profits for a period of three years, subject to non-distribution of dividends by the startup.

Assistance in building connections

• establishment of a startup India hub, which will be a single point of contact for the entire startup ecosystem, and will help with networking, funding, interface with government, assisting startups, and mentoring;

• organizing one national and one international startup festival annually, as part of the Make in India initiative.

The startup industry in India is benefiting from holistic policy support, driven by the Startup India initiative. The initiative can be captured through the below framework, and serves as a role model for other countries to adopt. Here they are: