Riding the Global Wave

The global marketplace is usually discussed in regard to its opportunities for large multinational companies. What is discussed less are dynamic, entrepreneurial mid-sized or even small-sized firms that are reaping the benefits of international trade. While there are some high-profile examples of mid-sized firms from developed economies – most notably German Mittelstand companies and the like from Italy, Austria, and Scandanavia – innovative, globally-competitive mid-sized firms from emerging markets usually operate unnoticed. Yet, today, emerging markets are already a hot-bed for a number of firms that successfully challenge competitors on the global stage. The trend will only continue. Discussed below are mid-sized companies from Russia and China. What are their international strategies, and how do they differ?

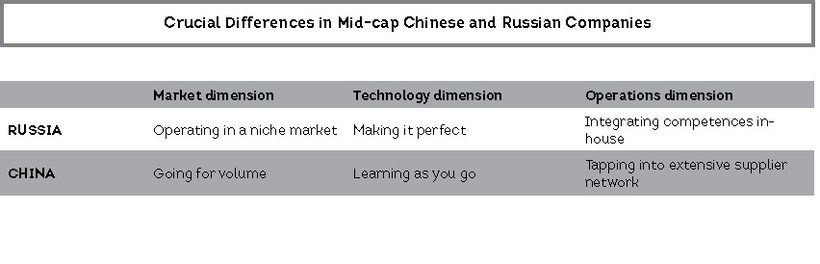

Mid-sized Russian and Chinese firms’ international strategy pattern is very much dependent on how they configure their business and the environment in which they operate. We have looked at three main dimensions – market, technology, and operations – that characterize the differences between mid-sized Russian and Chinese business and ultimately influence their global strategic response.

Market dimension: Operating in a niche market vs. Going for volume

A competitive landscape largely dictates the market strategy that a firm chooses to adopt. In the case of mid-sized Russian and Chinese business, this is particularly evident. In Russia, the market of consumer and industrial products is mainly dominated by big international players, leaving smaller firms little opportunity to compete in the mainstream. As a result, many mid-sized Russian firms respond by focusing on a specific niche. Such narrow specialization benefits them in a number of ways. First of all, it allows them to concentrate time, money, and effort on their core product, avoiding unnecessary stretching of limited resources. Secondly, by aligning their processes and practices around a given product or product range, companies are more likely to achieve better operational performances. Finally, working in a niche segment helps companies develop a high level of expertise in a particular product and thereby build customer intimacy and lasting relationships. A good example is August, a major Russian producer of plant protection solutions. Founded in 1990 by a chemical scientist as a distribution business, the company soon moved to launch their own production. Unlike its main rivals with large budgets, fully integrated value chains, and international clout, August had to play off other strengths. Underpinned by strong R&D, the company today offers highly specialized chemical mixtures and provides personalized technical support and training to farmers. Another outstanding example is Atlantis–Pak, which grew from a modest start-up in the south of Russia to become one of the world’s top three manufacturers of plastic casings for the meat and dairy industries. Working in a highly narrow product category, the company has exceled at quickly responding to evolving customer needs, including more specialized ones such as Halal practices.

Unlike in Russia, where companies see being mid-size as part of their identity and, in fact, often purport that they consciously do not want to grow, in China, mid-size appears to be just an intermediary stage in a firm’s development. Facing fierce competition at home, both from international and local players, mid-sized Chinese businesses seem to be under pressure to continuously increase in scale in order to survive. Volume-driven strategy is enabled through the cost advantage that many Chinese businesses enjoy. By selling products that offer a fair level of functionality and quality at a relatively low price, Chinese businesses find a great deal of traction, not only in the local market but also abroad, especially in other emerging economies. For example, the Chinese biotech company Sinocare first developed its rapid trace blood glucose testers specifically for local consumers but soon found interest in Africa, the Middle East, and Latin America. The success of mid-size Chinese companies is not limited only to the emerging world. Beijing-based TierTime Technology swayed the global market of portable 3D printers by focusing specifically on the US with its growing DIY and craft segments. Local enthusiasts did not mind the limited functionality of TierTime’s printers as long as they were affordable to purchase.

Technology dimension: Making it perfect vs. Learning as you go

Speed is one of the most notable characteristics of Chinese business overall and that of mid-sized ones in particular. Having a beta version is enough for a Chinese company to feel prepared to launch a product. Such rapid-fire innovation culture with a high degree of trial and error makes Chinese businesses very flexible and quick to gain from emerging opportunities. A good example is Goodbaby, today the world’s largest stroller-making company. First starting as an OEM manufacturer for international companies, Goodbaby did not do any design in-house. As they moved to own production, they learned to prototype products quickly and make subsequent adjustments based on client feedback.

In Russia, the mindset is different. The pursuit of excellence is something that is engraved in the engineering background that most the founders of the surveyed firms possess. It is often “love for the high-level mind game”, as one of the respondents confessed. Although such an approach results in some of the most technologically advanced solutions, it often keeps companies from being attuned to market needs. The success of Argus Spectr, a Russian developer of security and fire alarm devices and systems, has been largely contingent on its ability to understand its product shortfalls and adapt accordingly. In 2002, Argus opened a production facility in Italy, but the company soon realized that although the technical features of its products were excellent, the usability and visual appearance of the devices were lagging behind its foreign counterparts. The company subsequently created an Italian R&D facility that would focus on aesthetics, while leaving the development center in Russia to be responsible for the technical features. This combined approach proved to be successful and yielded higher sales, both in the Russian and European markets.

Operations dimension: Integrating competencies in-house vs. Tapping into extensive supplier network

The Russian business environment, being dominated by large companies and having a poorly developed SME sector, means less than plausible conditions for companies that do venture to do business. With limited outsourcing options and an insufficient supply of professional services and components, Russian companies are pushed to bring activities in-house that otherwise would be considered ancillary. Lighting Technologies, a leading manufacturer of professional light solutions, knows this like no other. In order to compensate for an unreliable supplier network, the company has essentially had to build a vertically integrated business by bringing in-house the production of optics and LED drivers as well as aluminum and plastic molding. Another example is Neurosoft, a world-renowned producer of medical equipment from a small city not far from Moscow. While the company sees development of medical software to be its core competence, it also has to have own production facilities, though this activity is usually outsourced in other parts of the world.

In China, the situation is starkly different. With the country long being the world’s main factory, it has an established comprehensive supplier network. Access to a wide pool of firms that work at different levels of the supply chain allows companies to have more choice and higher flexibility in configuring their business. When Gao Yunfeng, the founder of Han’s Laser, started his business in 1996, the laser equipment industry was practically non-existent in China. While having to rely on imported components in the very beginning, the company quickly went on to start manufacturing parts in China through local outsourcing partners. Being well-embedded in the local supplier network, mid-sized Chinese companies also more easily experiment with new product categories and adjacent markets.

Global strategic response

The way mid-sized Russian and Chinese firms configure their business along the market, technology, and operations dimensions largely dictates the logic and pattern of their internationalization. As mid-sized Russian firms mainly operate in narrowly-defined segments, they eventually exhaust growth opportunities at home and turn their attention to global niches. Internationalization for them is about getting access to new markets and expanding their client base. Underpinned by strong technological capabilities, global expansion has yielded a series of success stories: Lighting Technologies in India, August in Latin America, Neurosoft and Atlantis-Pak globally. Yet, compared to China’s, the achievements of mid-sized Russian firms in the international arena are much more modest, at least in numbers, not in terms of the footprint they leave in their respectful industries. Indeed, companies such as SPIRIT DSP, offering top- notch software solutions for real-time voice and video communications, and Diakont, specializing in the design and production of control systems for nuclear power plants, are acknowledged trendsetters in their fields.

Chinese firms, including that of the smaller size, are known for their dynamic M&A activity. While the learn-as-you-go approach helps them to swiftly establish themselves in the market and grow in scale, sooner or later, they encounter the need to enhance their technological capabilities in order to maintain a competitive position. Diverse purchases of European and American assets by Sinocare and Han’s Laser evidence just this. However, the trend is changing. An increasing number of mid-sized Chinese companies are becoming technological pioneers that bring to the world truly innovative and original products. Beijing SDL Technology, working in environmental analytics, and APUS, the fastest growing mobile Internet company, are just two of a myriad of examples of these rising champions.

Overall, it is evident that there is bourgeoning international activity involving mid-sized innovators from emerging markets. They are here to stay and are likely to shake up the global competitive landscape. Learning from them is vital for other companies that are to follow suit.