In the Urban Net

From London to São Paulo, from Chicago to Johannesburg, from Zurich to Mumbai – the whole world is entangled in a complex network of inter-industry ties connecting global cities. To be truly transnational, a business has to be present in a multitude of different cities both large and small that are often far from perfect. This serves as yet more practical evidence of the fact that the world is growing increasingly multipolar.

There is a strong tendency to think of cities as competing with each other. This in turn leads to concerns with what might be the ‘top five cities’ now and in the near future. Let me make the argument that this approach moves us away from understanding the key features of our emerging global urban economy. The future is not about five or ten cities topping the rankings. The future is more complex, and it is already emerging now.

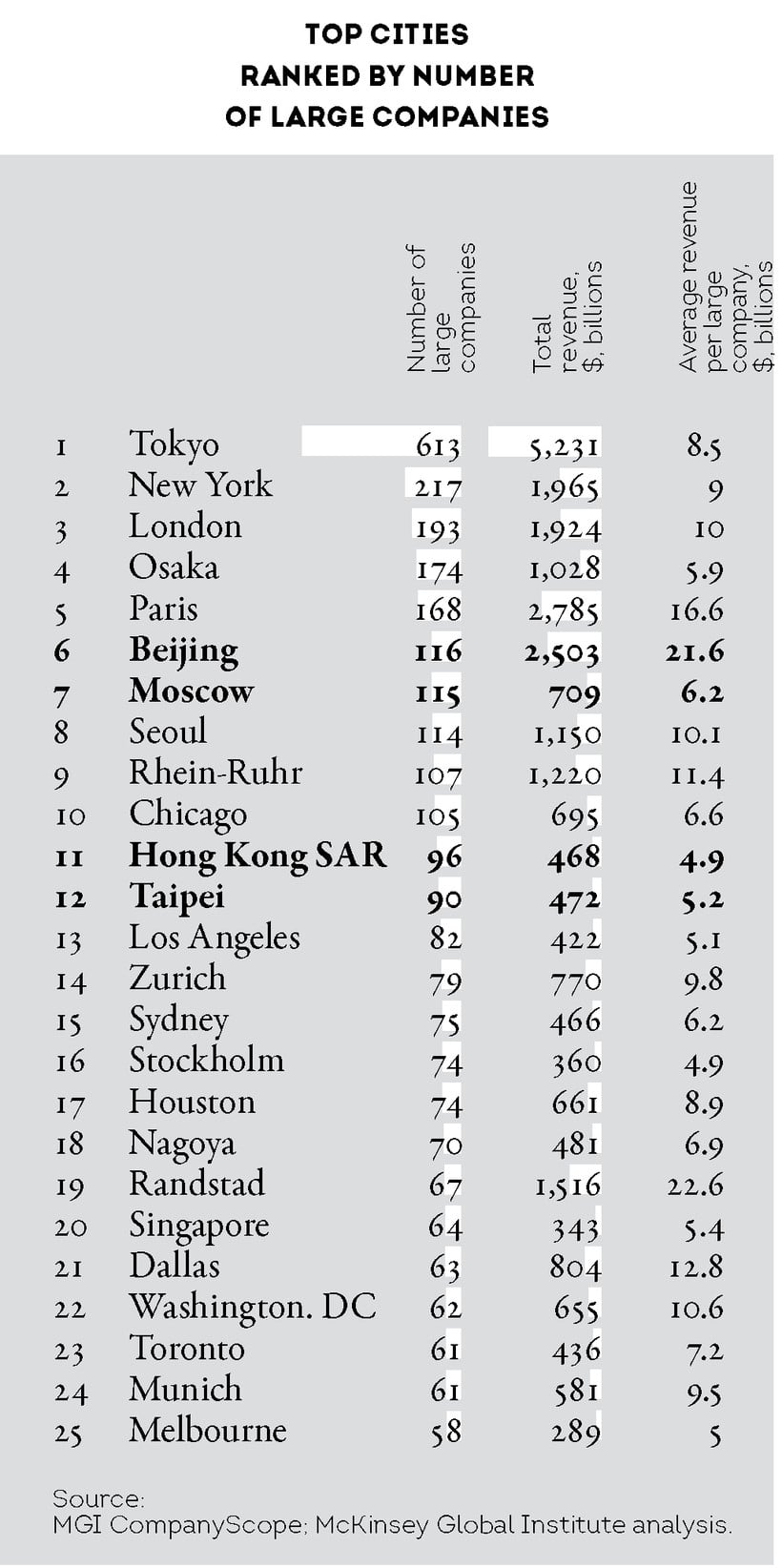

We are moving toward a multipolar world, one where cities are key spaces and nodes. In such a multipolar world, the notion of a top five or top ten is far less significant than the expansion of the network of global cities which now incorporates about a hundred urban centers. There is far less competition among these cities than is generally asserted or believed. In my own research I find that it is the specialized differences of cities that matter today, and it is this that matters in our global future. Understanding these features is the way to understand our global urban future.

Strategically important

For much of the 20th century, cities were above all centers for administration, small-scale manufacturing, and commerce. Cities were mostly the space for rather routinized activities. The strategic spaces where the major innovations were happening were the government (in the making of social contracts, such as the welfare state) and mass-manufacturing, including mass-construction of suburban regions and national transport infrastructure.

As recently as the 1970s, many of our great cities were in physical decay and losing people, firms, key roles in the national economy, and share of national wealth. New York was officially bankrupt, and so was Tokyo; London was informally bankrupt. Mumbai, Shanghai, Dubai, and many others were decayed and/or underdeveloped. As we moved into the last decade of the 20th and into the first of the 21st century, a rapidly growing number of cities had re-emerged as strategic places for a wide range of activities and dynamics. Critical, and partly underlying all the other dimensions, has been the new economic role of cities in national economies and in an increasingly globalized world.

The most common and easiest answers as to why cities became strategic in a global corporate economy are the ongoing need for face-to-face communications and the need for creative classes and inputs. Both are part of the answer. But in my reading, these are surface conditions and cannot fully explain the new phase.

The rise of cities as strategic economic spaces is the consequence of a deeper structural transformation evident in all developed economies. It affects cities at multiple levels, from provincial to global. At the heart of this deep structural trend is the fact that today even the most material economic sectors (mines, factories, transport systems, hospitals) are buying more insurance, accounting, legal, financial, consulting, software programming and other similar services.

These so-called intermediate services tend to be produced in cities, no matter the non-urban location of the mine or the steel plant that is being serviced. Thus even an economy centered in manufacturing or mining will feed the urban corporate services economy. Firms operating in more routinized and sub-national markets increasingly buy these service inputs from more local or regional cities, which explains why we also see the growth of a professional class and their associated built environment in cities that are not global. The difference for global cities is that they are able to handle the more complex needs of firms and exchanges operating globally.

The key feature of the current era is a vast number of highly particular global circuits that crisscross the world, some specialized and some not, which connect specific groups of cities. … If we were to track the global circuits of gold as a financial instrument, it is London, New York, Chicago and Zurich that dominate. But the wholesale trade in the metal brings São Paulo, Johannesburg and Sydney onto the map, and the trade in the commodity, much of it aimed at retail, adds Mumbai and Dubai

The outcomes of this structural condition become wired into urban space. The growth of a high-income professional class and high-profit corporate service firms becomes legible in urban space through the growing demand for state-of-the-art office buildings and all the key components of the residential sphere and consumption. The growing demand for these leads to often massive and visible displacements of the more modest-income households and modest-profit-making firms, no matter how healthy these may be from the perspective of the economy and market demand. In this process, urban space itself is one of the actors producing the outcome. This partly explains why architecture, urban design and urban planning have each played such critical roles.

A global city model

Beginning in the 1980s we saw the partial rebuilding of cities as platforms for a rapidly growing range of globalized activities and flows, from economic to cultural and political. This explains why global cities become an object of investment, beyond being a place for investing in, and why the number and types of cities that became such objects expanded rapidly as globalization expanded from the 1990s onwards.

When I first developed the global city model in the 1980s, my starting points were the global networks of affiliates of firms, global financial exchanges, global trade routes, and global commodity chains.

The emergent scholarship on globalization examining these global operations emphasized geographic dispersal, decentralization and deterritorialization. This was indeed all happening. But I was interested in the territorial moment of all these increasingly electronic and globally dispersed operations. At that time my idea was to focus on New York and Los Angeles. They seemed to be major territorial nodes. But sticking to my own methodology – starting with the global operations of firms and exchanges, and tracking the sites where they hit the ground – forced me to recognize that in the 1980s it was New York, London and Tokyo that stood out, with Los Angeles way, way down the list.

Applying this methodology today leads to a vastly expanded global geography of sites. There is more of everything: export processing zones, off-shore banking centers, massive warehouses that are one stop on global trade routes, and many more global cities.

Chain geography

There is no such entity as ‘the’ global economy. There are global formations, such as electronic financial markets and firms that operate globally. But the key feature of the current era is a vast number of highly particular global circuits that crisscross the world, some specialized and some not, which connect specific groups of cities.

While many of these global circuits have long existed, what began to change in the 1980s was their proliferation and their increasingly complex organizational and financial framings. These emergent intercity geographies began to function as an infrastructure for globalization, and for increasingly urbanized global networks.

Even a highly imperfect global city is better for a global firm or exchange than no such city. And this then explains why the many and very diverse global cities around the world do not just compete with each other, but also collectively form a globally networked platform for the operations of firms and markets

Different circuits contain different groups of countries and cities. For instance, Mumbai is today part of a global circuit for real-estate development that includes investors from cities as diverse as London and Bogotá. Coffee is mostly produced in Brazil, Kenya and Indonesia. But the main trading place for futures on coffee is Wall Street, even though New York does not grow a single bean. The specialized circuits in gold, coffee, oil and other commodities each involve particular places, which will vary depending on whether it is a production circuit, a trading circuit, or a financial circuit.

If we were to track the global circuits of gold as a financial instrument, it is London, New York, Chicago and Zurich that dominate. But the wholesale trade in the metal brings São Paulo, Johannesburg and Sydney onto the map, and the trade in the commodity, much of it aimed at retail, adds Mumbai and Dubai.

New York and London are the biggest financial centers in the world. But they do not dominate all markets. Chicago is the leading financial center for the trading of futures, and in the 1990s Frankfurt became the leading trader for – of all things – British gilts. These cities are all financial leaders in the global economy, but they lead in different sectors and are different types of financial centers.

Not only global economic forces feed this proliferation of circuits. Migration, cultural work and civil society, which struggles to preserve human rights, the environment and social justice, also feed their formation and development. Thus NGOs fighting for the protection of the rainforest function in circuits that include: Brazil and Indonesia, as homes of the major rainforests; the global media centers of New York and London; and the places where the key forestry companies selling and buying wood are headquartered, notably Oslo, London and Tokyo.

There are particular music circuits that connect specific areas of India with London, New York, Chicago and Johannesburg, and even more particular music circuits that connect parts of China with Los Angeles.

Adopting the perspective of one of these cities reveals the diversity and specificity of its location on some or many of these circuits. These emergent intercity geographies begin to function as an infrastructure for multiple forms of globalization. The critical nodes in these intercity geographies are not simply the cities, but more specifically the particular, often highly specialized, capabilities of each city.

Further, a critical trend is that, ultimately, being a global firm or market means entering the specificities and particularities of national economies. This explains why global actors need more and more global cities as they expand their operations across the world. Handling these national specificities and particularities is a far more complex process than simply imposing global standards.

This process is easier to understand if we consider consumer sectors rather than organizational or managerial ones. Even such a routinized operation as McDonald’s adjusts its products to the national cultures in which it operates, whether that is France, Japan or South Africa. When it comes to managerial and organizational aspects, matters become more complicated.

The global city contains the needed resources and talents to bridge between global actors and national specifics. Even a highly imperfect global city is better for a global firm or exchange than no such city. And this then explains why the many and very diverse global cities around the world do not just compete with each other, but also collectively form a globally networked platform for the operations of firms and markets.

The network of global cities has expanded as more and more firms go global and enter a growing range of foreign national economies. The management and servicing of much of the global economic system takes place in this growing network of global cities and city-regions. And while this role involves only certain components of urban economies, it has contributed to a repositioning of cities both nationally and globally.

This repositioning of cities and the move away from intercity competition is further strengthened by the emerging fact that cities are at the forefront of a range of global governance challenges. Because of this, many cities have had to develop capabilities to handle these challenges long before national states signed international treaties or passed national laws. The air quality emergency in cities such as Tokyo and Los Angeles back in the 1980s is one instance: these cities could not wait until an agreement such as Kyoto might appear, nor could they wait until national governments passed mandatory laws for car fuel efficiency and emissions. With or without a treaty or law, they had to address air quality urgently. And they did. Cities have even shown a willingness to go against national law when the urgency of confronting particular conditions demands it.

Finally, the urgency of such global challenges in cities takes on a further practical character with the urbanization of war. The new military asymmetries arising out of conventional armies confronting networked insurgencies tend to produce an increasingly urban geography of war. In this context, the expanding presence of cities in global networks and the expanding number of intercity networks take on added meanings, because cities are not about war; they are about commerce and the civic. The more cities are involved in global transactions, the more they will be a voice against war and international military action.

A picture of the multipolar world

A picture of the multipolar world

While there is competition between cities, there is far less of it than is usually assumed. A global firm does not want one global city, but many. However, given the level of specialization of globalized firms, the preferred cities will vary according to the firm. Firms thrive on the specialized differences of cities, and it is these that give cities their particular advantage in the global economy.

The other side of this dynamic is that for a firm to go global it has to put down feet in multiple cities that function as entry points into national economies. This bridging capacity is critical: the multiple circuits connecting major and minor global cities are the live infrastructure of the global economy. This indicates that cities do not simply compete with each other. A global firm does not want just one global city, even if it is the best in the world. Different groups of cities will be desirable, even if they have some serious negatives. This helps explain why there is no one ‘perfect’ global city. Today’s global phase does not function through one imperial global capital that has it all. In this growing number of global cities – and their differences – we see the larger story of a shift to a multipolar world.

Saskia Sassen is Robert S. Lynd Professor of Sociology, Co-Chair of the Committee on Global Thought at Columbia University. She is also the author of Cities in a World Economy, Territory, Authority, Rights: From Medieval to Global Assemblages and A Sociology of Globalization.

Illustrations by

Matthew Cusickmattcusick.com