Welcome to Piauí

Brazil’s sustainable macroeconomic indicators and continued consumer boom are an excellent incentive for foreign investments. To expedite this process however, the government will have to tackle a number of significant challenges, including defeating bureaucracy and implementing tax reform.

Over the past several years the desire to win the hearts and minds of investors has virtually become the key imperative that underlies the policies of national governments across the globe. This hardly comes as a surprise, especially considering the fact that incentivising investments today is, bar none, the most effective way to accelerate economic growth and improve the quality of economic infrastructures. In other words, it is the quickest way for most developing countries (and all other countries for that matter) to achieve an end state that hardly requires lengthy explanations.

In this sense Brazil is certainly no exception. Over the last decade the government has spared no efforts in reforming the economy and enhancing the investment climate, and now they have much to show for their hard work. I would even venture to say that, in terms of macroeconomic indicators, Brazil is currently in peak form, to use a sports analogy. We have stabilised our currency and put inflation under control: throughout the entire last year we managed to maintain it at 5.8%. Our foreign debt is relatively low – less than 55% of our GDP – and we have sufficient financial reserves both to sustain our commitments and maintain stability. All of the above go to show that today macroeconomic risks for investors in Brazil remain exceedingly low.

It is also worth noting that throughout this entire period investments remained the key driver that spurred on Brazil’s economic development. The unprecedented growth that the country saw in the early 2000s enabled it to build the sixth largest GDP in the world. However, more importantly, the ensuing economic boom helped millions of Brazilians to cross the poverty line, transforming them into financially sound consumers. It is certainly no coincidence that the rate of unemployment in Brazil remains at 5.4% – an historically low level against the backdrop of the global economic recession. In the meantime, the country continues to go through a period of consumer boom.

Yet it is also common knowledge that the rate of economic growth has significantly slowed down of late. Last year our economy showed a mere 0.9% growth, reaching R$4.4 trillion (US$2.2 trillion). Parenthetically, one of the main factors contributing to the slowdown was a drop in direct investments: the share of these investments in the capital assets of Brazilian companies has gone down to 18.1% of the GDP, the lowest level since 2007.

The explanation lies on the surface: in the context of a protracted economic recession, investors do not seem to be too keen to invest in new projects; they prefer to move their funds to ‘safe’ countries. The United States, which managed to shake off the effects of recession faster than other countries, would be the most obvious case in point. Needless to say, Brazil faces its own specific challenges, which currently prevent the country from pitching itself to investors in a more favourable light.

In terms of macroeconomic indicators, Brazil is currently in peak form, to use a sports analogy. We have stabilised our currency and put inflation under control: throughout the entire last year we managed to maintain it at 5.8%. Our foreign debt is relatively low – less than 55% of our GDP – and we have sufficient financial reserves both to sustain our commitments and maintain stability

The first aspect I would like to focus on is the notorious Brazilian bureaucracy. Sluggish and top-heavy, it plays a significant role in blocking the influx of investments into the country. Attempts to enhance the efficiency of the Brazilian bureaucratic machine have been made on a regular basis, and Brazil’s President Dilma Rousseff has taken a proactive stance, vowing to combat all forms of red tape. Some of the measures include temporary laws and steps to improve the flexibility of certain processes and procedures. However, this is clearly not enough for a long-term solution to the problem on a systemic level.

Another equally significant obstacle comes in the form of tax legislation, which remains imperfect and cumbersome. Today’s Brazil is in dire need of tax reform. However, unfortunately, the National Congress (the country’s parliament) has put this issue on a slow track. The federal government does not consider this reform as one of its top priorities either. So far, instead of issuing explicit directives to legislators, the cabinet seems to give preference to temporary measures and provisional legislative acts, hoping to find a way out of this stalemate. This is why the process is being yanked forward at an extremely slow pace.

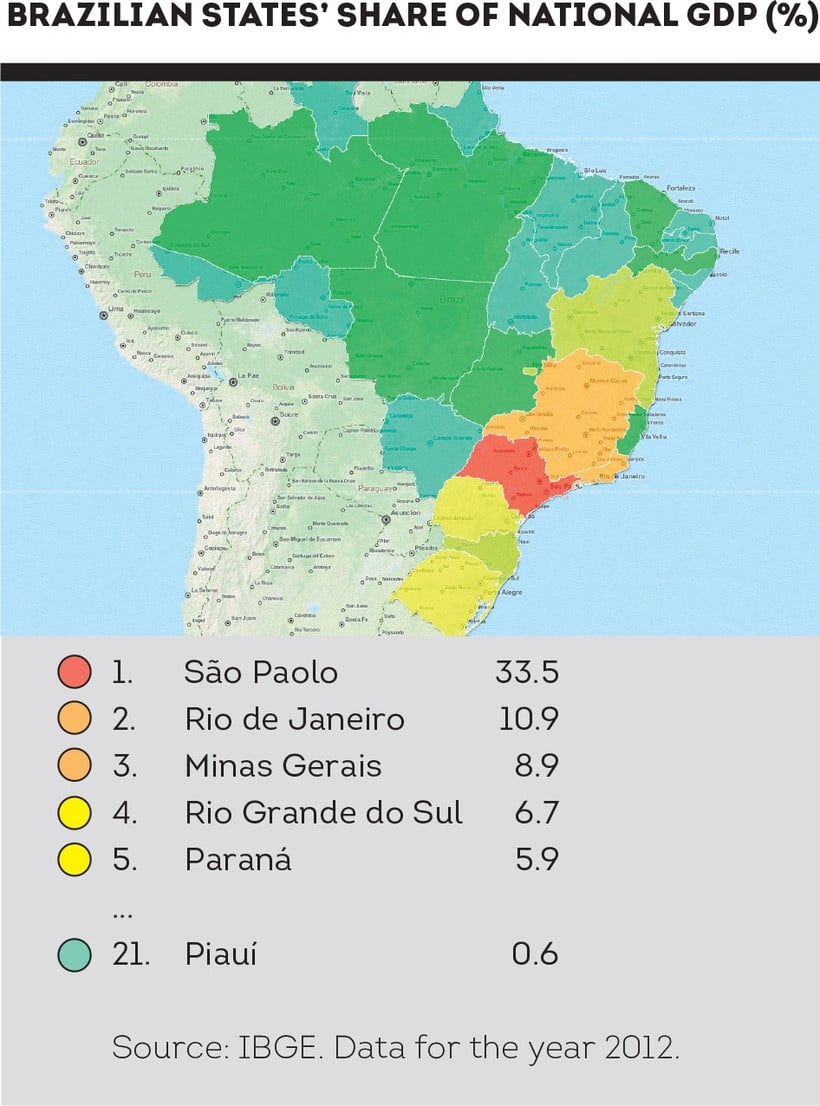

Finally, significant regional investment imbalances continue to pose another challenge for our country. For many years, investment resources – primarily in the industrial sector of the economy – have been concentrated in or channelled towards the South and Southeast regions (the so-called Rio de Janeiro-São Paulo axis), which continues to create undesirable regional distortions in the country’s economic development.

The solution to the problem lies increasingly in the hands of regional authorities. They should make it their priority to improve the investment climate in their respective territories. Our track record in the state of Piauí shows that this approach can yield excellent results. We continue to pursue a proactive policy to incentivise investors through various tax benefits. For instance, investors who create at least 500 jobs are exempt from local taxes for a period of ten years. Furthermore, foreign investors may be eligible to obtain preferential loans to develop projects in the state if they opt to set up a joint venture with one of the local companies.

In any event, I have no doubt whatsoever that Brazil will be able to successfully tackle all of the challenges that still prevent the country from realising its investment potential to the fullest. Perhaps this would help to dispel a number of negative stereotypes attributed to our country, many of which are not true even today.

In the real world however, Brazil remains absolutely stable at the macro level, while the Brazilian people are more than willing and able to adopt a constructive approach; their appetite for change and development is incredible. All of the above mean that investors who choose to come to our country will not regret the move.

Wilson Nunes Martins is the Governor of the state of Piauí, Brazil.