Billions Online

Last year will enter history as the year when China surpassed the United States and became the largest e-commerce market in the world. The experts paint the profile of a typical Chinese online shopper and provide insights on how this consumer trend can make businesses money.

The year 2013 will be remembered as the one in which China surpassed the US as the world’s largest digital retail market. Each year delivers impressive growth as China’s shoppers heartily embrace e-commerce. Online sales are expected to continue on their amazing trajectory, reaching 3.3 trillion yuan by 2015.

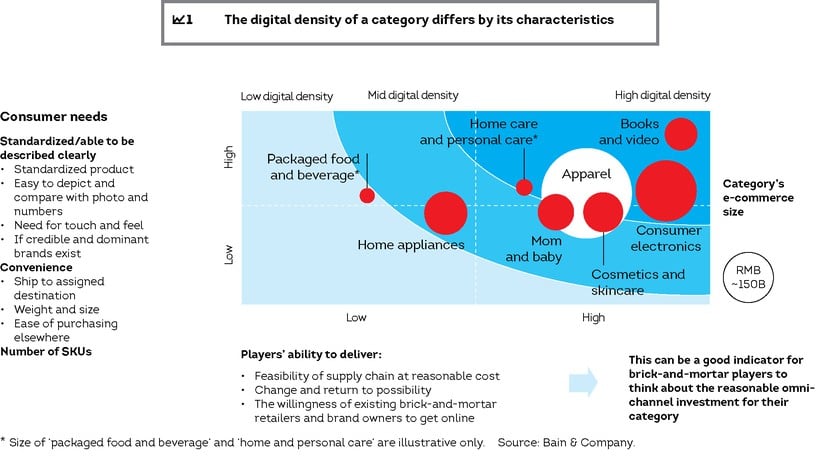

To better understand how Chinese consumers shop and purchase online – and the implications for retailers and brands – Bain & Company surveyed more than 1,300 online shoppers across China. Among our findings are that Chinese shoppers have been more willing than those in other markets to use their smartphones to make purchases, and that they are comfortable with third-party payments and online banking. But perhaps most important, we learned that digital retailing now is the major influence on their actual purchasing decisions.

In a surprising finding, more than half of those surveyed said that, regardless of where they end up making the purchase – online or in the physical store – they browse websites and make price comparisons before they buy. Such distinctive behavior is reflected in the quick popularity of Etao, a website that allows consumers to compare prices and then quickly navigate to the e-store offering the best one.

And nearly 70% of shoppers who bought online first went to a physical store to see the product and make their selection. Because Chinese shoppers move easily between physical stores and online options, online sites support brick-and-mortar store sales, and vice versa.

How China’s online shoppers are different

Chinese shoppers are coming into sharper focus:

- Instead of showing exclusive loyalty to a single brand, in most categories they tend to choose from multiple brands for the same need or occasion. They not only tend to buy multiple brands, but they also buy from different e-commerce stores.

- They are bargain hunters. Half of those surveyed said price was the number one reason for going online.

- More than 60% of surveyed shoppers said they relied on smartphones to browse or buy products.

- They purchase massive numbers of products on overseas sites – for lower prices, or when they have health concerns, or when they want to ensure a product is genuine.

- They usually start shopping online with inexpensive apparel like t-shirts and then move on to bigger-ticket categories.

Pure plays dominate

As it explodes, China’s digital market is also making a dramatic shift from consumer-to-consumer (C2C) sites like Taobao – which introduced shoppers to online buying – to business-to-consumer (B2C) sites like Tmall, which respondents told us they trust more than consumer sites. Tmall, where the majority of China’s B2C purchases take place, has deftly shaped online retailing in China.

Online-only pure plays lead the market over omni-channel retailers – those with both a physical and online presence.

Four factors contribute to a pure play’s success:

1. Building scale for the price sensitive. Winners create enough scale to allow them to offer lower prices. But scale alone won’t suffice without a winning value proposition.

2. Streamlining the assortment and price for a differentiated portfolio. Some pure plays win by offering a well-priced product portfolio that differentiates them from the pack, focusing on areas such as luxury fashions or mothers and infants. Redbaby and Blue Nile adopted this approach, which led to their early success.

3. Honing a profitable business model. Companies need to have the resources to invest iin areas such as infrastructure and marketing and to cover losses for a long time as they build scale.

4. Creating a strong supply chain. Yihaodian built a sophisticated, self-owned supply chain to handle the complex grocery category. It invested heavily to build an in-house delivery capability to serve the unique needs of grocery distribution, with logistics centers in key markets and an in-house delivery team to serve core cities.

The omni-channel promise

The Tmall phenomenon

As retailers and brands frame their strategies, they can’ t minimize

the importance of Tmall, the dominant site where the majority of China’s

B2C purchases take place. Tmall generated revenues of RMB 180 billion

in 2012, and the site has deftly shaped online retailing in China.

Consider its iconic 11.11 digital retail event, in which shoppers are

offered up to 50% discounts on most products. The single 24-hour period

in November fully delivered 7% of Tmall’s annual revenues in 2012,

according to company reports. By the end of the day, 213 million unique

visitors had logged on, the company reported, accounting for 106 million

transactions.

As retailers and brands frame their strategies, they can’ t minimize

the importance of Tmall, the dominant site where the majority of China’s

B2C purchases take place. Tmall generated revenues of RMB 180 billion

in 2012, and the site has deftly shaped online retailing in China.

Consider its iconic 11.11 digital retail event, in which shoppers are

offered up to 50% discounts on most products. The single 24-hour period

in November fully delivered 7% of Tmall’s annual revenues in 2012,

according to company reports. By the end of the day, 213 million unique

visitors had logged on, the company reported, accounting for 106 million

transactions.

A presence on Tmall is critical for any merchant trying to establish a foothold with China’s online shoppers. Given its scale and ability to deliver enormous traffic, Tmall serves as a good entry option for brick-and-mortar retailers or brands that want to get shoppers comfortable with the experience of buying online. Then retailers can focus on convincing shoppers to make purchases on their own sites. Trouble is, our survey found that consumers often confuse flagship stores on Tmall with retailers’ own e-commerce sites. The challenge is to clearly differentiate the retailer’s e-store from its Tmall offering.

Ultimately, Tmall helps everybody grow, and fast. Its 11-11 digital holiday creates a halo effect that makes those 24 hours an exciting time for all online retailers in China.

While pure plays dominate, the opportunities are huge for omni-channel merchants. Given its scale and ability to deliver enormous traffic, Tmall serves as a good entry option for brick-and-mortar retailers or brands that want to get shoppers comfortable with the experience of buying online. Then retailers can focus on convincing shoppers to make purchases on their own sites.

Like their pure play counterparts, omni-channel merchants – retailers and brands alike – need to master some key factors for success:

1. Investing early. Leaders stay ahead by having a clear vision and a strategy that allows them to be the first to invest, either growing organically or making key acquisitions. Most successful brick-and-mortar retailers scale up their digital businesses within two years, and they prepare their organizations for rapid change. Having an early start was critical for Suning, China’s largest omni-channel retailer, in building a digital presence that enhanced its physical operations. The strategy called for developing a user-friendly website with rich content and a heavy technology investment to ensure seamless online and in-store fulfillment. Over time, it expanded categories online, in its stores and on mobile applications. Suning worked to fully integrate its digital and store channels. By 2012, the retailer had solidified its leadership as the number-two B2C online player. Having an early start was critical.

2. Building a dedicated digital team. A successful team incorporates digital capabilities into different functions. At the outset, the team is often separate from the rest of the organization. After Suning set up its omnichannel vision it established a separate digital team—an independent operation with a highly entrepreneurial culture.

3. Investing in a world-class website. Companies work with third-party website developers to speed the process. Apparel brand and retailer Uniqlo outsourced development for both its official Uniqlo site and another on Tmall. Web giant Taobao provides the ordering and payment systems. Such outsourcing accelerated Uniqlo’s online launch by tapping partners’.

4. Expertly managing assortments and price. Some apparel companies feature a full range of items with prices in line with those in its physical stores. But brands also use sites such as Jingdong (also known as jd.com) to offer lower-price deals on a limited variety of products. Retailers must master the art of using pricing and merchandising to differentiate themselves from pure plays.

5. Developing a seamless cross-channel experience. Winners create an enriched shopping experience by integrating their online, mobile, and social-media presence and taking full advantage of their stores. For example, they can allow shoppers to return online purchases to a nearby store. Or shoppers can check a store’s inventory online or log onto a terminal in a store to make a purchase.

The bottom line is straightforward: As digital retailing sweeps China, brick-and-mortar retailers and brands are well positioned to exploit a tremendous opportunity. But they need to act quickly and thoughtfully to wed offline and online strengths. Otherwise, they risk becoming irrelevant over time.

Serge Hoffmann is Partner at Bain & Company in Hong Kong, Consumer Products and Retail practice.

Pierre-Laurent Wetli is Partner at Bain & Company in Moscow, Consumer Products and Retail practice.