Digital Continent

Africa is on the verge of an online revolution, and the first stage is already underway. Businesses, especially international ones, stand a great chance of striking gold if they can get in on this trend now.

Africa, the world’s second largest and second most populous continent, is entering a digital revolution, which is as complex as it is exciting. Propelled by social, economic, and political changes, this transition goes hand in hand with a move towards urbanization. However, these are not the only factors driving the emergence of the digital economy.

It is important to examine and analyze Africa’s path towards digitalization and focus upon the economic changes and future opportunities likely to arise from it. In doing so, the findings of a McKinsey & Company 2013 report, Lions go digital: The Internet’s transformative potential in Africa, (referred to hereafter as The McKinsey report) is quite helpful.

Current and expected growth

The potential of the African continent cannot be underestimated. In order to understand this, it is imperative to understand the continent’s current socio-economic status. The McKinsey report suggests that despite Africa’s current underutilization of technology and its suppressed Internet capacity, this is set to shift significantly in the coming two decades.

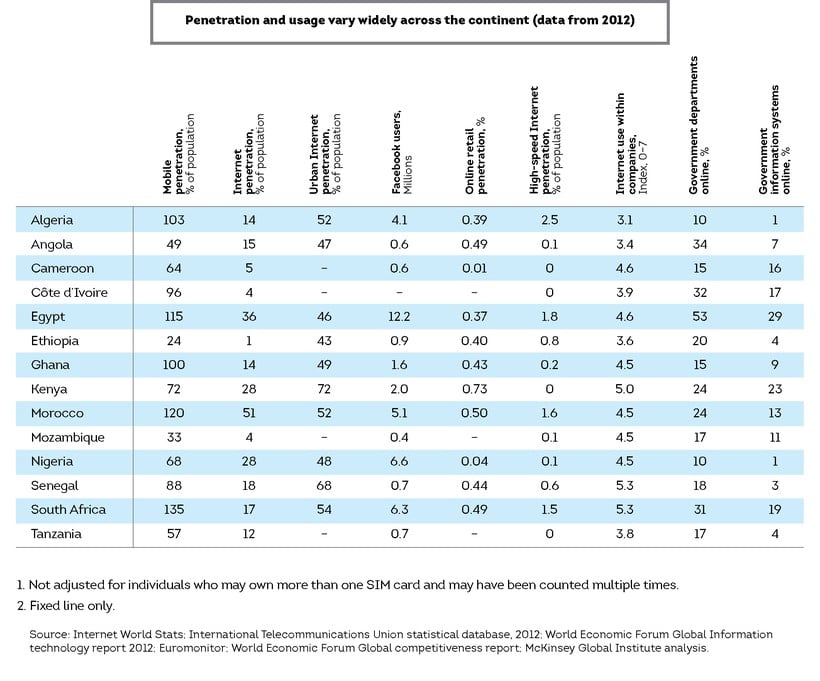

In terms of numbers, the growth forecast is staggering. In 2013, Internet penetration within the continent stood at 16%; by 2025, this is expected to have risen to 50%. This translates to a rise from 167 million Internet users in 2013 to an estimated 600 million users by 2025.

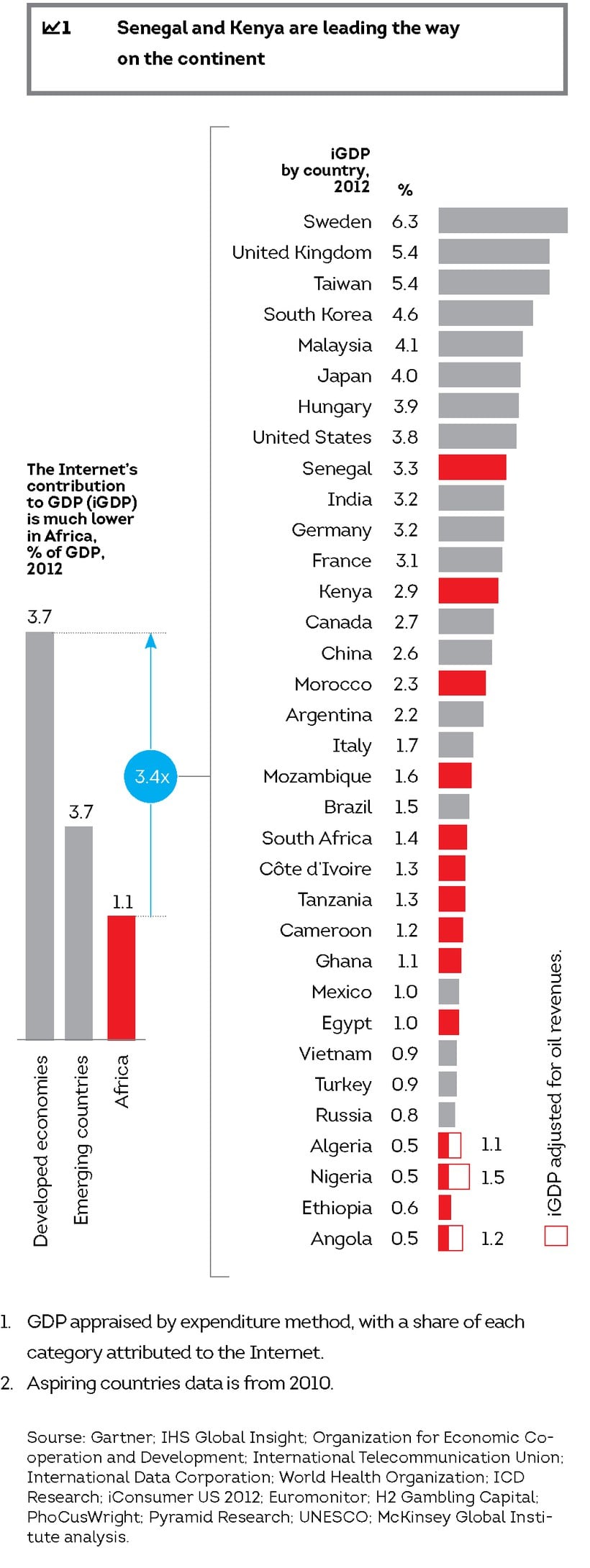

To put that into perspective, the online consumer market will roughly quadruple in size over the next 12 years. This equates to a rise in the Internet’s contribution to GDP (iGDP) from $18 billion to $300 billion. Such rapid economic growth will inevitably increase global and domestic interest from companies looking to tap into the growth of new users and their online global brand preferences.

While there is value in examining and reviewing the continent as a whole, it is also important to understand how individual markets will develop, and at what pace. Ethiopia and Senegal are a case in point.

On one side of the spectrum is Ethiopia with an iGDP of 0.6%. On the other hand, Senegal’s iGDP stands at 3.3%, which is much closer to that of developed economies.

The McKinsey report suggests that Africa’s iGDP as a whole could accelerate to 5-6%, which would be on par with Taiwan, the UK, and Sweden. Just achieving this would be a success story for Africa, but some forecast that iGDP could grow by 10% to reach $300 billion by 2025.

This forecast would produce a corresponding effect on online private consumption, increasing it to $154 billion across the continent by 2015. Although such forecasts provide a very positive indication of growth, this will not be achieved on its own. At present, public expenditure on Internet access is approximately $3 per capita.

African tech start-ups, such as Jobberman, moWoza, and Rekindle, are demonstrating a level of sophistication akin to their Western counterparts. This has ignited investment in incubator and start-up networks, resulting in tech ecosystems comparable to those in developed economies. The most notable are Cameroon’s ActivSpaces, Ghana’s MEST, Kenya’s iHub,

Liberia’s iLabLiberia, Nigeria’s Wennovation Hub, and South Africa’s JoziHub

However, on the basis of current proposed information and communications technology (ICT) strategies across Africa, public expenditure exceeds $150 per capita. Although this level of investment would still lag behind developed nations, it would exceed that of Brazil. If this were to be achieved, it would stimulate and act as a catalyst for private sector investment and underpin an upsurge from the current $2.45 per capita to $52 per capita.

Drivers of the transition

It would be unwise to generalize the attributes of the African economy given the various stages of economic development in each nation. Some countries’ digital growth will be driven almost exclusively, in the short term at least, by private consumption, while in others, the main catalyst will be Business Process Operations (BPO). That said, the continent as a whole is entering a perfect storm in terms of its transition, with a number of key factors taking place.

Firstly, there is the demographic advantage.

Africa is the world’s most youthful continent with 200 million people between the ages of 15 and 25. This demographic is widely recognized as early adopters of technology. Young people are also receptive to social network engagement, which would mean that the predictions of Internet penetration discussed above are by no means an unrealizable prospect.

Secondly, it is necessary to consider the significant increase in incomes.

Within a decade, incomes are expected to exceed $5,000 in 128 million households. That income level is the threshold at which households begin to spend half of their income on items other than food – i.e., the advent of a disposable income.

For the first time in modern history, the increase in surplus income will create a unique opportunity for millions of Africans to engage with, innovate, and spend money on digital technology. This has already happened with the basic smartphone – prices have now dropped below a $100 tipping point, allowing low cost mobile technology access to the masses.

Thirdly, there is the entrepreneurial culture.

This has emerged as a driving force behind innovation and has also fueled economic development. Thus, the expansion of the Internet has become a launch pad for entrepreneurs and their new innovations.

African tech start-ups, such as Jobberman, moWoza, and Rekindle, are demonstrating a level of sophistication akin to their Western counterparts. This has ignited investment in incubator and start-up networks, resulting in tech ecosystems comparable to those in developed economies. The most notable are Cameroon’s ActivSpaces, Ghana’s MEST, Kenya’s iHub, Liberia’s iLabLiberia, Nigeria’s Wennovation Hub, and South Africa’s JoziHub.

Global players, such as Microsoft, have moved quickly to form partnerships with leading African incubators to support start-ups. Google has also been active in helping to provide low cost, high-speed wireless broadband in South Africa.

Global players, such as Microsoft, have moved quickly to form partnerships with leading African incubators to support start-ups. Google has also been active in helping to provide low cost, high-speed wireless broadband in South Africa.

On a more basic level, Kenyan non-profit Ushahidi has been developing a device to overcome the pervasive lack of reliable Internet connectivity. This is done via their innovative device, BRCK, which has the ability to switch between power sources and networks seamlessly.

An attribute these start-ups all share is ambition – many desire to expand and develop beyond their home country and the African continent. Some of the emerging companies are truly ‘micro-multinationals,’ whose ability to utilize current technology and reach a global audience and market is unparalleled.

Fourthly, the above factors have led to a corresponding increase in investment, with Africa undergoing both a deal flow and value transformation.

On the ground, local angel investor and venture capital networks are taking shape; they are inspiring confidence in global investors, who are starting to see Africa as a desirable investment haven offering impressive returns.

The final key factor is urbanization.

Internet access will increase from its current 40% to 50% by 2030, and will be complemented by infrastructural advancement through private and public expenditure, which will increase Internet speeds.

Government initiatives and strategic national visions have been instrumental in digitalizing Africa. Following investment from the Kenyan Government, Google Chairman Eric Schmidt commented, “Nairobi has emerged as a serious tech hub and may become the African leader.”

Last year, the Rockefeller Foundation hosted a meeting in New York focusing on the economic opportunities arising from Africa’s digital transition. One significant theme was capturing the outsourcing market, which is worth an estimated $512 billion. Until recently, this was a market that Africa was unable to substantively tap into.

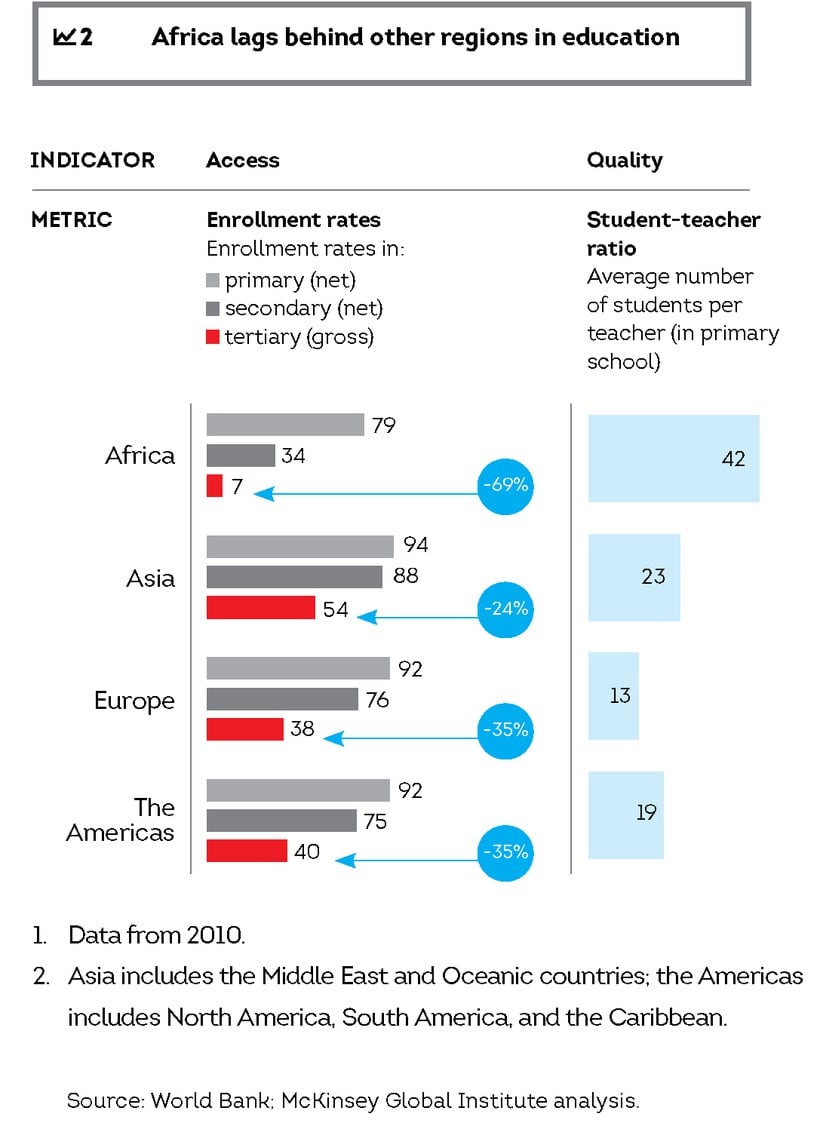

Developed nations outsourcing to developing nations can save up to 40%. If Africa were able to fully realize its potential, youth incomes could rise by 200%, with a similar effect on education and future opportunities.

Developed nations outsourcing to developing nations can save up to 40%. If Africa were able to fully realize its potential, youth incomes could rise by 200%, with a similar effect on education and future opportunities.

Sector specific analysis

The effects of digitalization will be profound, with particular benefits in the following sectors:

Finance. Given that only one-fourth of the adult population in sub-Saharan Africa has a bank account, the growing penetration of Internet and technology will have an unprecedented effect on financial inclusion. This can already be seen with the success of companies such as M-Pesa, a mobile phone-based money transfer and microfinancing service. Digitalization will apply a downward pressure on transaction costs, encouraging micro trades and stimulating growth.

If forecasts are accurate and technological advances continue along current trends, 60% of Africans will have access to banking services by 2025, and more than 90% will be using e-wallets for daily transactions. Financial inclusion will be a driving force behind economic development and could facilitate a boom in e-commerce. For instance, m-Shwari and m-Kesho, both of the M-Pesa suite of products, provide access to savings and insurance and micro-credit facilities respectively via mobile phones.

Education. Digitalization will remove physical barriers and make education more accessible. Digital tools will also empower individuals to take charge of their own educational needs by delivering instant access to educational resources, enhanced teacher training, and improved learning outcomes.

Health. The sheer size of Africa has often been cited as an obstacle to health services. With only 1.1 doctors per 1,000 patients and 2.7 nurses per 1,000 patients, providing healthcare is a major problem.

It is envisaged that technology will allow users to interact online with healthcare service providers so that centralized services become more efficient and effective. Some benefits can already be seen with mPedigree, a company that seeks to reduce product counterfeiting.

Consumers in West Africa can now send an SMS to verify if the medicines they are about to purchase are fakes. It is estimated that a technology-driven healthcare system could save Africa between $84 billion and $188 billion per year.

Retail. Traditional forms of retail in Africa have suffered and remained undeveloped. But e-commerce, bolstered by financial inclusion, could replace traditional retail shops by offering a new shopping experience in terms of choice, quality, and cost. Online retailers can often offer customers savings of approximately 10% compared to traditional stores.

Agriculture. Digital tools will provide this industry with the necessary data to drive growth, efficiency, and economies of scale. The Internet will provide access to data on weather, crop selection, and pest control, and enable users to make informed decisions on land management. Furthermore, it is likely to lead to access to new markets and reduce food prices.

The African Development Bank Group has calculated that growth in the agricultural sector is twice as effective at reducing poverty than growth in any other sector. A leader in this sector is the Ethiopia Commodity Exchange (ECX), which has leveraged technology to create an efficient modern trading system. The ECX, set up five years ago, is now the largest commodity exchange in Africa.

Macro benefits

MGI Research found that Internet maturity correlates with higher living standards and has a positive effect on healthcare, education, and social mobility.

The digital economy will also result in increases in productivity. As costs come down, access to cloud computing, secure storage, enhanced software, email, and enterprise systems (such as payroll and billing) will become commonplace. Consequently, this will reduce costs for both businesses and consumers.

The future

The economic prospects outlined above will inspire confidence. However, this should be considered within the landscape of inherent uncertainty risks. Although forecasts of economic growth are based on data and empirical evidence, they are by no means guaranteed. In order for predictions to be achieved, the following conditions must be met:

1. Network Infrastructure must continue to develop and the cost of devices must continue to fall or remain stable;

2. Access to capital must increase;

3. ICT strategies must be developed to accom-modate security of servers and online transactions;

4. A strong ecosystem must be developed; and

5. Government initiatives must have a coherent vision and political foresight.

Nzube Ufodike is Director of Amoo Venture Capital Advisory, Co-Founder of place4BRICS.