The Win-Win Gas Game

The $400 billion gas supply deal signed in May by Russia’s Gazprom and China’s CNPC will bring long-term benefits to both countries. Not only does it secure the resource-hungry Beijing a major source of cleaner fuel, but it also opens up the world’s most promising energy market to Moscow, enabling it to ease its dependence on hydrocarbon exports to Europe and drill in remote territories of the Far East.

Scanning the vast expanse of Russia’s Far East and East Siberia on a world map, it is easy to make a connection between the region’s huge hydrocarbon reserves and the energy-hungry Asian markets across the border. Yet Russia and China have been unsuccessful in negotiating Russian pipeline gas deliveries for more than a decade. Russia’s enormous resource base remained dormant as the country concentrated its energy efforts on delivering gas, oil, and refined products to the Western markets. Meanwhile, China’s rapid economic expansion was increasingly reliant on coal-fired electricity, wreaking havoc on the country’s environment.

The long-awaited gas contract was finally signed by Russia’s state-owned monopoly Gazprom and China National Petroleum Corporation (CNPC) on 21 May during Russian President Vladimir Putin’s visit to China.

“This is the biggest contract in the history of the gas sector of the former USSR,” said Putin, after the agreement was signed in Shanghai, citing Chinese friends as hard negotiators. “Through mutual compromise we managed to reach not only acceptable, but rather satisfactory, terms on this contract for both sides. Both sides were in the end pleased by the compromise reached on price and other terms.”

No pricing details were announced beyond the fact that it will bring Russia $400 billion in revenue on supplies of 1 trillion cubic meters of gas for 30 years to China via a new Eastern pipeline linking the two countries. The pricing was estimated to be between $350-390/Mcm, which is widely believed to be hovering around Gazprom’s break-even point of delivering gas to China’s gates. To make the contract work, the Russian government may cancel the mineral extraction tax rate for the fields that will supply gas to China.

For now, the ends seem to justify the means. The contract appears to mark a fundamental shift in cooperation between both countries, and a pivot to the East in Russia’s energy strategy. More importantly, it is evident that both countries have nothing to lose and everything to gain from rapid expansion in energy cooperation.

China: Meeting the Demand

One clear reason for China’s plunge into the gas game with Russia is demand, which is facing exponential growth that cannot be met by its own resources. For almost a decade, Beijing subsidized domestic gas prices to encourage diversification of its coal-heavy energy balance, which allowed local gas resources to cover consumption and keep prices low. But in recent years, conventional resources were unable to keep up with exponential growth in demand. Thus, China was forced to turn to more expensive sources of imported gas from Central Asia and liquefied natural gas (LNG). Its own unconventional gas deposits, besides being expensive to develop, have so far failed to yield significant results.

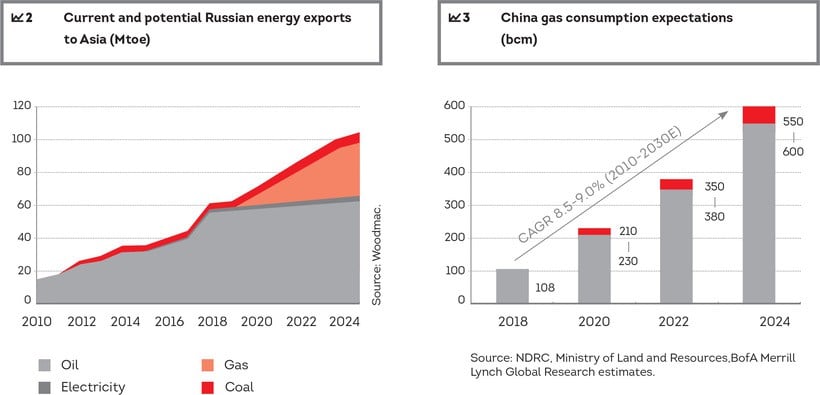

The demand for gas in China has already doubled over the past five years and even under most conservative assumptions, it is now expected to triple by 2030. Estimates suggest that even with increases in imports of LNG, Central Asian gas, the development of domestic unconventional resources, and deliveries of 38bcm of Russian gas, China will still face a shortage by 2030

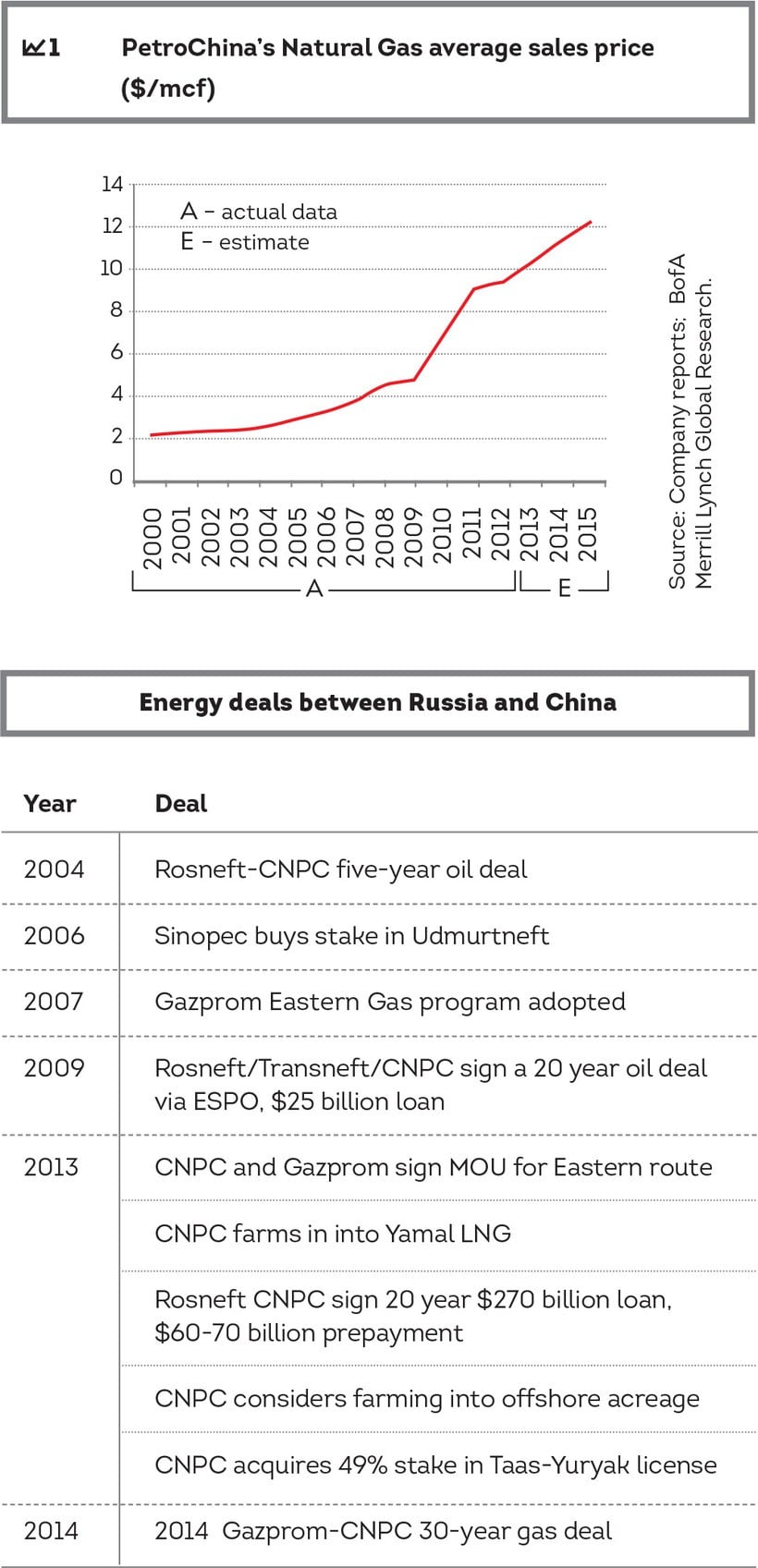

Faced with growing demand and a depleted resource base, the Chinese government is gradually phasing out subsidies for domestic gas. As such, pricing for domestic gas increased by three-fold in the past five years, reaching an export parity level for imported gas in 2014. The current gas price of almost $13/mmbtu is similar to prices that Gazprom charges its European customers. Domestic pricing in China now fulfills Russia’s fundamental demand for similar pricing between China’s and Europe’s gas deliveries.

Faced with growing demand and a depleted resource base, the Chinese government is gradually phasing out subsidies for domestic gas. As such, pricing for domestic gas increased by three-fold in the past five years, reaching an export parity level for imported gas in 2014. The current gas price of almost $13/mmbtu is similar to prices that Gazprom charges its European customers. Domestic pricing in China now fulfills Russia’s fundamental demand for similar pricing between China’s and Europe’s gas deliveries.

China’s explosive economic growth has also wreaked havoc on its environment. Smog from coal burning electricity plants now regularly covers cities in some parts of the country and puts a severe strain on the country’s water supply. The country’s Premier declared that the smog in the cities is “nature’s red light” against unchecked development. Late last year, the government introduced sweeping legislation to its environmental regulation and committed $280 billion to clean up pollution. The new plan focuses on renewable energy and additional gas capacity to decrease coal’s share in the country’s energy balance.

However, the demand for gas in China has already doubled over the past five years and even under most conservative assumptions, it is now expected to triple by 2030. Estimates suggest that even with increases in imports of LNG, Central Asian gas, the development of domestic unconventional resources, and deliveries of 38bcm of Russian gas, China will still face a shortage by 2030.

One clear reason for China’s plunge into the gas game with Russia is demand, which is facing exponential growth that can’t be met by its own resources. For almost a decade, Beijing subsidized domestic gas prices to encourage diversification of its coal-heavy energy balance, which allowed local gas resources to cover consumption and keep prices low. But in recent years, conventional resources were unable to keep up with exponential growth in demand

Russia: Opening Up the Resource Base

The contract positions Russia well to further increase its exports to China. The opportunity looks like a windfall for Moscow in many ways, as it helps to supply China’s ever-increasing appetite for energy.

One obvious benefit of the deal is the need to develop the Far East. Russia’s extensive gas resources in East Siberia and the Far East were unused for decades. While the regions cover a vast area, they are home to only around 10 million people. Domestic demand cannot justify the development of these resources and building pipelines to the West or to LNG terminals is proving to be prohibitively expensive. While initial pricing for piped gas to China might not seem financially lucrative to Gazprom, it will allow Russia to monetize its resource base, meet domestic demand in the East, provide gas to its LNG plant in Vladivostok, jumpstart economic growth in the Far East, and replenish state and regional budgets.

Another benefit is Russia’s need to diversify its energy markets. The Russian domestic gas market remains severely oversupplied. The 2008-09 crisis saw demand plunge both in Russia and its only export market, Western Europe. The recent political spat between the West and Russia over Ukraine is also forcing Europeans to rethink their dependence on Russian gas deliveries. Russia, in turn, is being forced to increasingly look to the Eastern markets and LNG to solve domestic oversupply and diversify away from Western European markets.

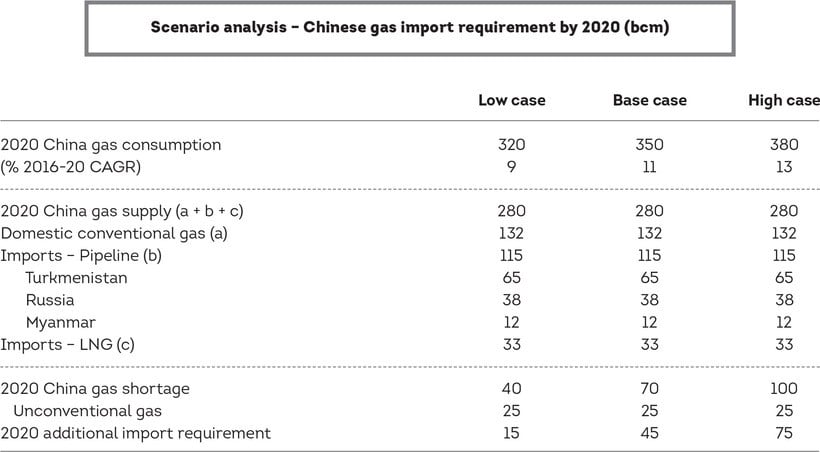

In fact, the Russian gas deal follows on the footsteps of multi-billion dollar deals already signed with China by Russian oil companies which committed to deliver as much as 20% of their future output to China (up from the current 6%) by 2025. With the launch of the Eastern Siberia-Pacific Ocean oil pipeline in 2009, and its expansion in 2012, Russian energy giants such as Rosneft and Transneft successfully installed the infrastructure and routed parts of their existing oil output to Asia. Rosneft’s unprecedented $270 billion, 20-year oil delivery deal with CNPC in 2013 now requires the development of East Siberian and Far Eastern oil fields.

China’s explosive economic growth has wreaked havoc on its environment. Smog from coal burning electricity plants now regularly covers cities in some parts of the country and puts a severe strain on the country’s water supply

It is no surprise then that realizing the importance of the Eastern direction, the Russian government implemented a sweeping taxation reform to allow the development of Russia’s Eastern energy resources. To support the development of the Far East and East Siberian fields, the Russian government developed and passed into law in 2013 several tax breaks, including on East Siberian greenfield projects, tight oil developments, and offshore oil fields. The new laws dramatically lowered the marginal tax rates for new oil barrels and, according to our estimates, significantly raised the profitability of potential new projects.

The evolution of thinking is also evident on the Russian corporate level. Once protective of their resource base, Russian companies are now allowing Chinese conglomerates to get minority stakes in upstream projects.

With the new gas deal in place, we now expect that energy cooperation between China and Russia will quadruple from 30Mtoe in 2013 to nearly 120Mtoe by 2025 as Russia attaches increasing importance to the Eastern direction. This is clearly a win-win situation for both Russia and China.